日本語 | English

The Japanese Insurance Industry is one of the largest in the world and a concentrated market with a mix of Dominant Domestic and Foreign Insurance players. The land comes with unique challenges and risks such as natural disasters, growing aging population, declining birth rates, weakening Yen, increasing medical costs, saturating growth in major LoBs such as Auto, Individual life insurance and finally the slow adoption of Digital Transformation (DX) initiatives when compared to global insurers.

We believe that Japanese insurers face challenges due to existence of legacy technology and complex IT architecture in one hand and in the other hand the abundant availability of technology options such as AI, Appification, Low code no code platforms, Automations, IoT, Geo-spatial etc. It requires the right set of talent and capability to improve and optimize the current IT landscape and embrace new digital technology for growth.

Industry Overview and Outlook

The major Insurers will continue to expand their businesses overseas while the domestic market is saturated due to shrinking population. General Insurance underwriting profits comes from Automobile Insurance followed by Fire and Accident and Health Insurance. Frequent natural disasters are impacting Fire business`s profitability. The current revenue model i.e.: achieve profitability through rate revisions of general insurance companies is not viable. Japan's life insurance outlook remains optimistic as insurers expand through non-traditional channels such as digital, reforms in medical insurance, annuity products and by expanding overseas business.

Japanese Insurers are compelled to provide product innovation due to technology progression witnessed in other industries. The development of Autonomous vehicles, adoption of ADAS, the gaining popularity of preventive health through wearables, shifting from digital shopping experiences to robotic shopping and dining experiences etc. would require an innovative insurance solution to address these unique risks.

To build a sustainable business model, Insurers to simplify the products and riders with easy-to-understand terms and conditions. This will lead to an increase in premium income and efficiency through digital direct sales and self-service models. Huge opportunity and growth for the insurers who invest in data and analytics capabilities to innovate products and services and handle claims efficiently. Customer portals with embedded engagements to improve QoL (Quality of Life) provide new avenues of growth.

Insurance DX Opportunity, Strategy and Realization

The Japanese insurance industry is experiencing a significant challenge in adopting technological advancements, customer centric business models and value creation through eco-system partners. A robust Digital Transformation (DX) strategy is required to drive efficiency, enhance customer experience and remain competitive amidst concentrated market dynamics.

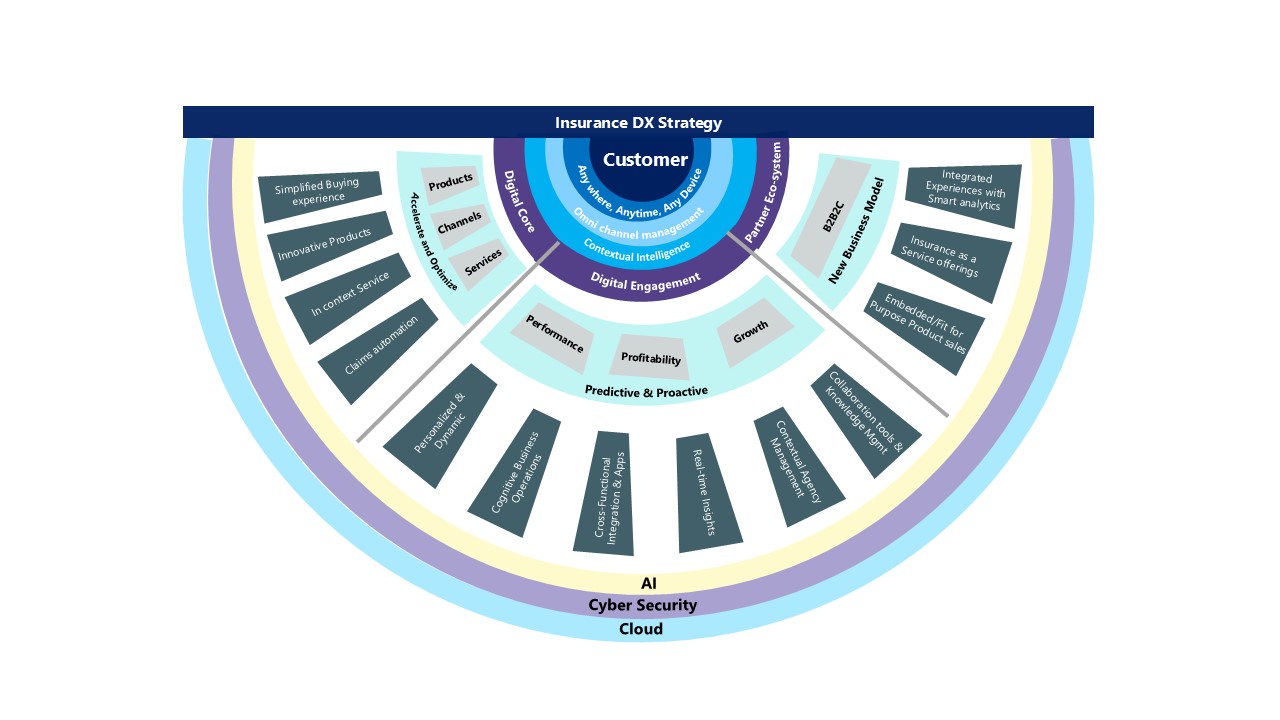

Our Views on Insurance DX Strategy

DX strategies provide a long-term gain including streamlined operations, personalized services, and improved risk management to become more customer centric. Digital technologies like AI, Cloud, IoT, Big data, Computing technology, Blockchain, Cyber security, Integrated systems etc. have been pivotal in transforming Japan's insurance landscape. These technologies enable accelerated product design, automated underwriting and claims management and meaningful customer interactions. The core pillars of DX strategy are

1) Create a Customer-Centric business model

Create an environment to envision fit for purpose and simplified products with elevated customer interactions beyond the mere transaction base. Contextualize the diverse needs of the customer based on the age group, risk profile and challenges of Japanese business organizations through knowledge acquired and generated through the digital technologies like mobility, AI, big data and analytics. Gen AI provides exponential capabilities in virtual customer interactions and actionable insights across the customer journey right from purchase, post sales services and claims management.

2) Build efficiency in Core Insurance operations

Digitizing and streamlining core functions of Insurance is the key priority in formulating DX strategies. Build operational efficiency through

- Complement agent interactions with Personalized insights and streamline sales completion cycle with automation and advanced analytics

- Expand distribution with user friendly digital self-service capabilities

- Build a product configurator with easy to design products and riders

- Dynamic Quote using digital technology such as Telematics (Automobile), Wearables (Medical, Accident and Health), Geo-spatial (Property Insurance)

- Quicker and seamless policy services and claims processing with AI assistants and automated workflows

- Predictive and proactive interactions to prevent/mitigate losses and post loss scenarios

- Zero touch claims processing of low, medium severity claims with automatic fraud detection and claims payment

3) Digital First Engagements

Expand customer engagement models with Extreme digital, Human+AI with following capabilities

- Ability to complete the service in a preferred channel without breaking the customer journey

- Seamless switchover between channels and continuity of services

- Digital enablement for Sales Intermediaries to perform seamless sales and service

4) Enable B2B2C Digital Business model

Convergence of businesses is inevitable in today’s business world. Combined core competencies of ecosystem provide enormous growth opportunities and greater customer experience. Some of the B2B2C business model innovations that drives growth in Insurance business are

- Embedded Insurance or Insurance-as-a-service platform with adjacent businesses in Health, Home, Mobility, Life and Annuities enables to tap into untapped customer base with new capabilities

- Pre and post policy services such as Vehicle maintenance, Property risk management, cyber, cross border risks etc.

- Envision products and services based on insights on the impact of corporate activities on the environment (SDGs), cyber security, employee wellbeing of businesses.

- Continuous health monitoring and in-context advise and

- Insurance product for Autonomous driving and envision services based on driving behavior data

Accelerating insurance DX Strategy

Accelerate the DX initiatives with a well formulated DX capability model. A DX leader who is digitally savvy with insurance business knowledge will become the driving force of these initiatives. Currently the Japanese Insurers need to address the talent gap of DX leader and acceleration of DX initiatives. The following depicts DX capability model to accelerate DX initiatives.

Pioneering DX implementation needs a strong DX talent which can be achieved through in-house or trusted IT vendor with multitude of capabilities and operations across the world. Outsourcing strategy enables the in-house DX leader with digital talent, upskilling, retention and acceleration of DX realization through the array of technology partnerships and alliances. Formulate DX strategy with sustainable, easy to intervene and correct the course when there is an advancement of technology or change in business drivers. Measure the digital maturity of the organization and revisit the strategy every once or twice a year to stay competitive. We examine the prevailing insurance landscape, envision a future state, recommend and accomplish the future state for insurers in the journey towards digital insurance future.

The Way Forward

The Insurance Industry in Japan have huge responsibility to address emerging risks of industries to declining birthrate with aging population in an innovative way to stay competitive and profitable. Some future challenges of Japanese Insurance industry are as follows,

Envision Products to address Evolving business risks

We foresee emerging risks of business are industrial automation, cyber security, geo-political differences, health and wellbeing, business negligence in adhering to regulation, greener economy etc. Address those risks through contextualizing innovative products and services for an industry or a region.

Work towards achieving Net zero by 2050

Ready access to data and advanced modeling technologies accomplish short-term/long-term Net Zero targets in Underwriting and Investments policies

Reforms in Medical Insurance

Baby boomer generation who will be over 75 years by 2025, are projected to drive up the usage of healthcare services. Preventive Health services and structured medical insurance products in B2B2C model will be a key differentiator

Gen AI is here to stay

Gen AI investments will become a key budget item to optimize the operations, marketing and customer engagements. Develop a scalable Gen AI platform by enabling data and strengthening the capabilities and frameworks to accelerate realization of use cases.

We believe the current DX investment provides efficiency in insurance operations, yet it necessitates continuous relook of the DX strategy and capability to embrace the latest technology developments, respond to changing consumer behavior, insurance business environments and risks.