日本語 | English

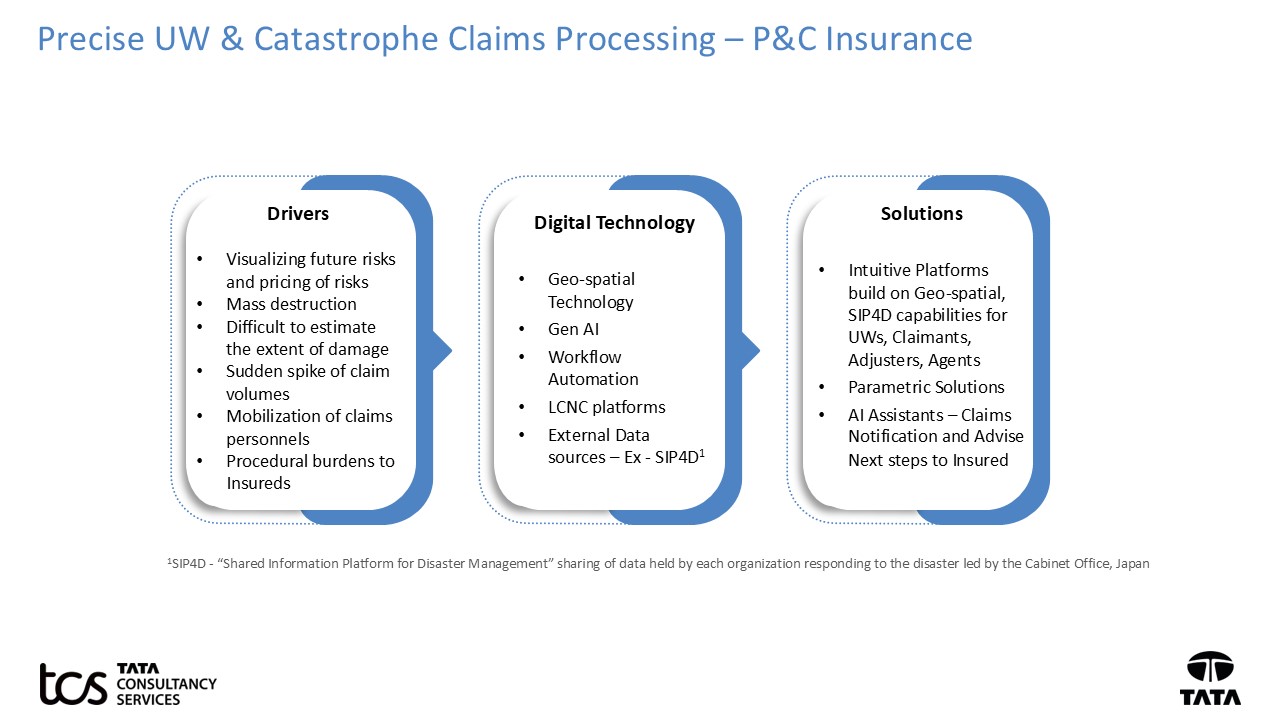

In August, we are all advised to `be prepared` for the possibility of Megaquake in Japan. While the advisory lasted a week, it’s high time that the Insurance companies relook or adapt digital technology for precise underwriting of properties, offer parametric solutions, intuitive policy service, loss mitigation and prevention with respect to catastrophes, rapid claims response and settlement after a disaster. GIS technology and AI provide multitude of capabilities to insurers by combining meaningful data from inside and outside the organization in the form of configurable geo spatial layers, contextual advisory and helps Insurers to take more accurate and informed decisions in underwriting, policy service, claim settlement and post loss recovery.

Agenda

Insurance Industry Challenges

Weak risk assessment and underwriting have a negative impact to both Insurers and Insureds. Underwriters require a clear picture of the risks involved in issuing policy with required coverage and limits. In parametric insurance, the challenges arise in determining the premium/payout and sometimes the claims paid does not match the actual losses of Insured. Loss avoidance is not possible in case of catastrophes but it can be mitigated by providing in-context advisory to Insureds before the catastrophe strikes and guiding the Insureds to take measures to minimize the damages.

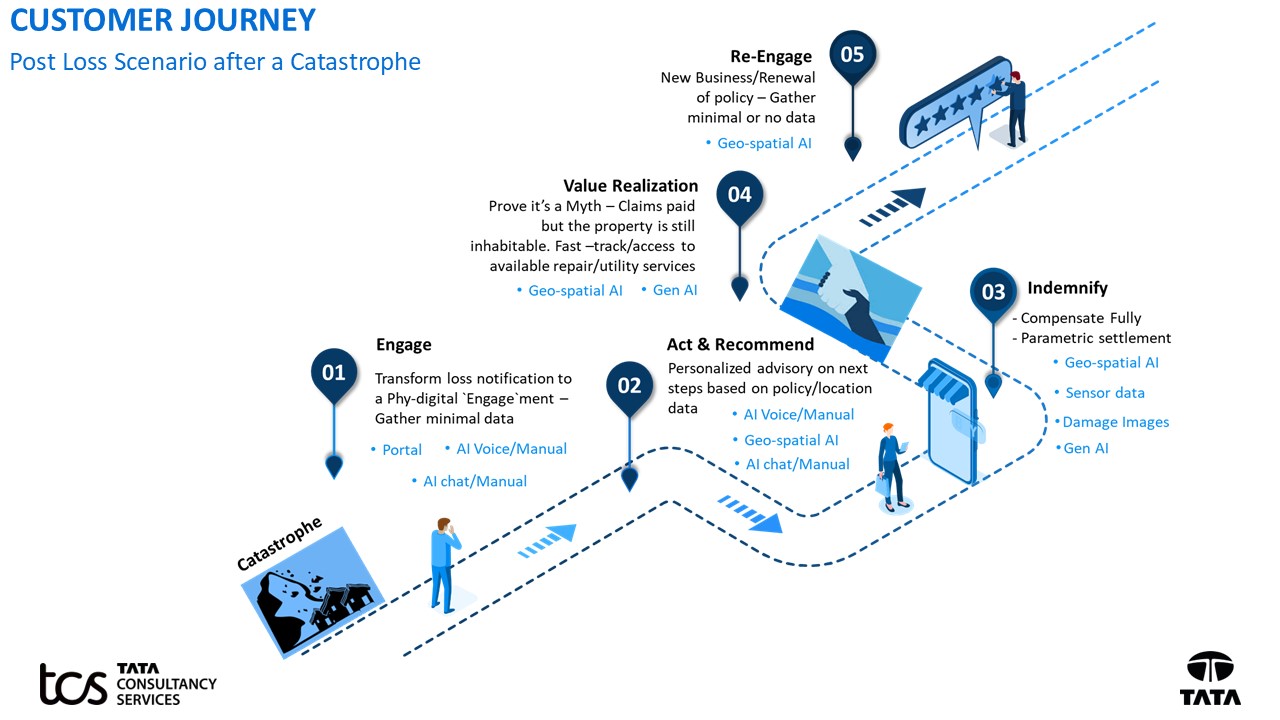

Dealing with post catastrophic loss is too traumatic for the insured. Adding complexity in reporting a loss, securing damage certification report, going back and forth for missed data on loss notification causes delays in claim settlement and Insured’s dissatisfaction. Most likely the customer may leave the insurance company after such a situation.

A clear picture of risks is unlikely to come from a single source. We foresee the primary challenges like discrete data, deriving clear insights from GIS, legacy underwriting and claims systems, manual processes, lack of AI talent etc. in integrating these technologies into underwriting and claims operations.

Towards resolving issues

An integrated platform to deploy the data from different sources ex-GIS, Indices, SIP4D… and create actionable insights to aid precise underwriting of risks, customer service and rapid claims assessment. GIS enables Insurers with a visualization capability to assess risk, understand the area spread and extent of damage to decide the next course of action to plan and assign adjusters, loss reserve estimation, recovery plan for Insureds after a catastrophe.

Enable traditional channels like Call centers, Agency, Customer Portal with AI capabilities such as AI based Voice or chat, Geo-Spatial AI to gather minimal data on First Notice of Loss, real-time advisory on road conditions, temporary accommodations, availability of medical services, mandatory repairs to avoid further damages.

Precise Underwriting, Loss Mitigation and Prevention of risk services and parametric solutions using Geo-spatial and AI

In recent years, Parametric solution is offered by many US and European insurers and it is still gaining traction in Japan. Parametric Insurance is designed based on 2 components, 1) the triggering event and common metrics used to measure triggering events such as earthquake magnitude, flood water levels, wind speed etc. 2) Pre-determined Payout amount. Traditional policy underwriting also requires 3600 view of catastrophic risks, determining the coverages and pay out limits based on the risk appetite of the Insured.

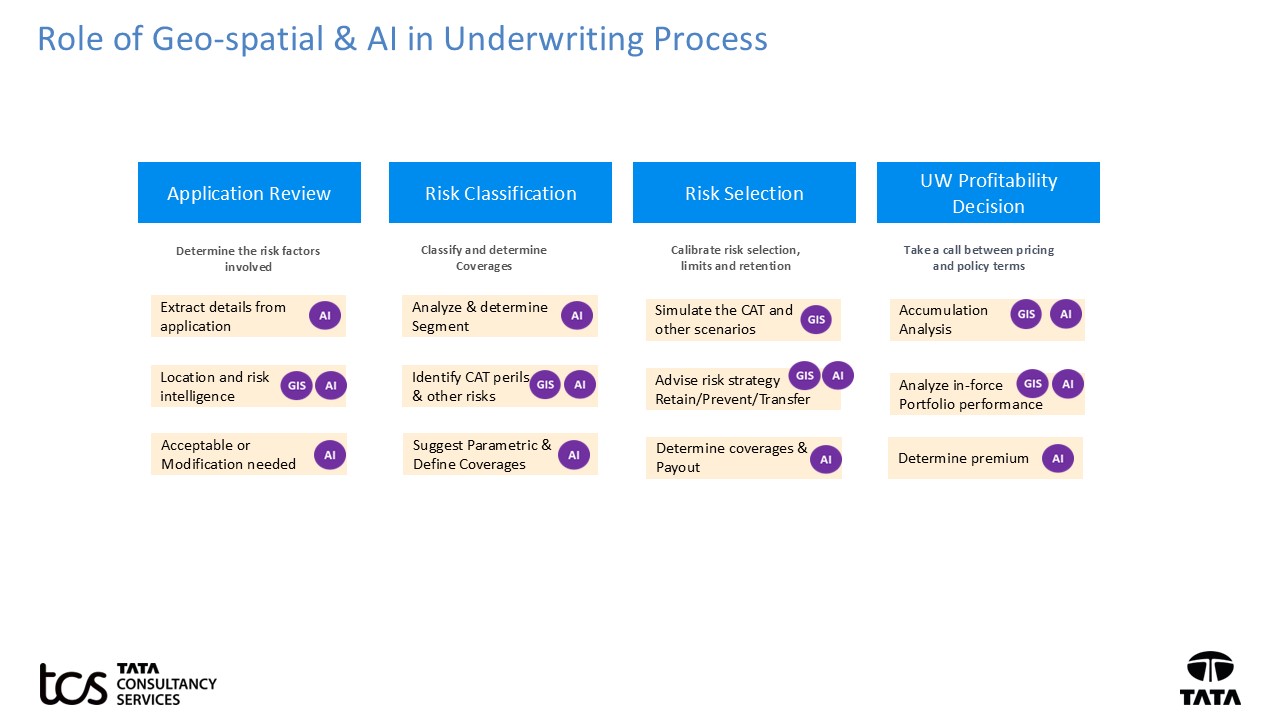

Geo-spatial information play a major role in improving the quality of data used in Parametric insurance and Underwriting. Underwriters can leverage geo-spatial combined with external data sources and AI provide a comprehensive view of risks and portfolio performance.

The following provides Geo-spatial and AI use cases to aid precise underwriting of risks.

Simplify the quotation process by gathering minimal data from the customer. Leverage geo-spatial technology to obtain a 3600 risk view of the property i.e.- get a detailed view of the property and CAT risks involved around the property. Geo-spatial view provides the total area, roof condition and, nearby location risks such as water, fire, wind etc. of the property. Predict catastrophes and other property risks – Type of CAT risks, Primary/secondary events occurrence after a main event ex- possible land slide after a typhoon, flood and inundation delays of indemnification process ex – Availability of Property repair services, resume from business interruption etc.

Leverage AI to predict the external risks for more personalized riders and limits selection. Ex- Interruption to customer`s business due to a supply chain route disruption caused by a flood. Underwriters can assess the policy accumulations specific to geographic regions for multiple perils and view the characteristics of in-force portfolio of policies. Assess the exposure of multiple perils such as fire, flood, earthquake, Typhoon… by combining multiple hazard attributes to aid underwriters to make informed decisions. Simulate potential impact and probable maximum loss from catastrophic perils. Create loss prevention and mitigation strategies to minimize the damage impact of a catastrophe.

Loss prevention and mitigation advisory is not just a one-time activity during policy issuance. This is a continuous effort to ensure the Insureds are protected with adequate coverages, measures they should take on the approaching catastrophe in advance. Geospatial and AI capabilities to enhance accuracy of premium calculation, improve Underwriting efficiency and profitability and envision Parametric products and intuitive policy services.

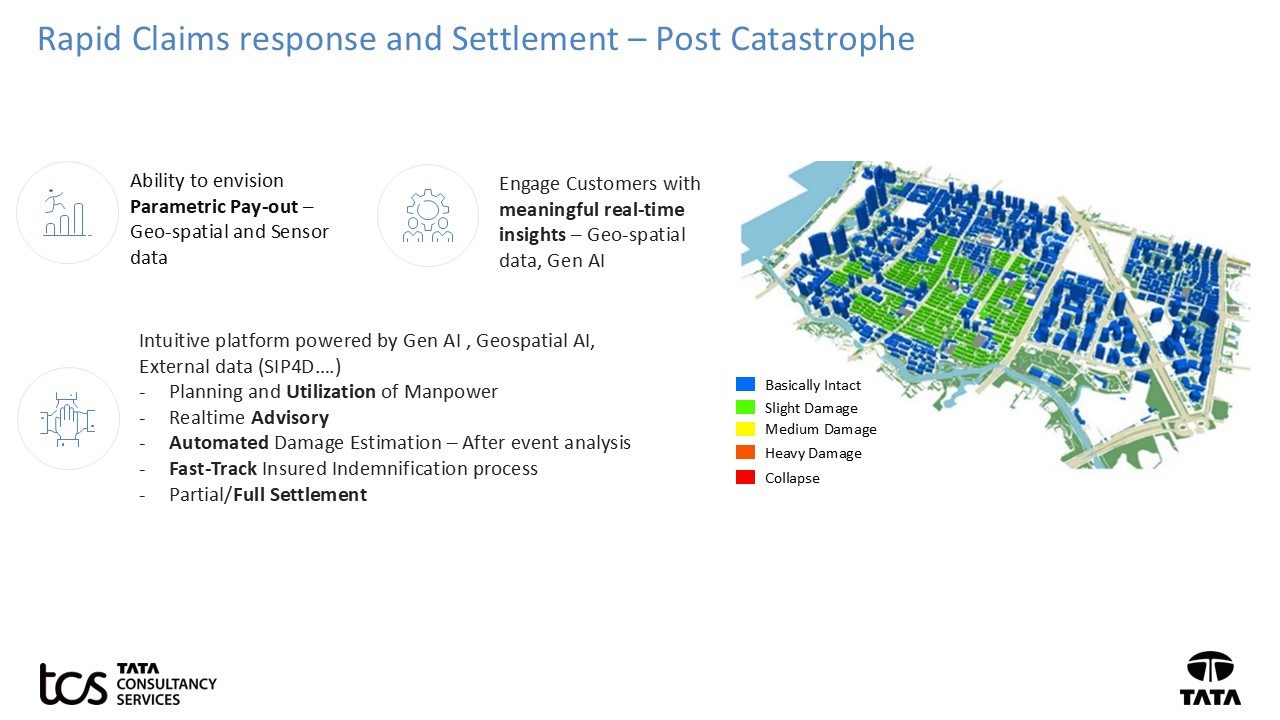

Rapid Claims response and Settlement – Post Catastrophe

Today`s Claims Business units are expected to have a pro-active catastrophic response strategy rather than reactive - `Be prepared in case of any event in all aspects`. Geo-spatial and AI adoption improves the Claims settlement process and post loss recovery of the Insured.

Information required for damage assessment is scattered in multiple internal systems and external data sources like SIP4D. Envision an intuitive platform powered by Geospatial AI, Gen AI that creates insights and actions for Adjusters/Claim operations based on data sources. This aids faster and efficient decision-making right from loss notification and settlement.

After a Catastrophe, Geo-spatial and AI enables the Claims department to quickly assemble the required information to

- Understand extend of devastation, concentration of losses to plan the available manpower workload and utilization

- Predict if any further loss/damage due to secondary event or aftershocks and generate real time advisory to Insureds and Claims adjuster to avoid further damage and reserve setting

- Create a Damage Estimation by performing before and after event analysis to reduce dependency on Insured to produce the damage reports

- Perform an impact analysis on Cost/Time required to repair/treatment/temporary roof arrangement based on labor availability, road access, hospital vacancy in the region.

- Facts driven Claim Estimation and immediate partial/Full Settlement to Insured

Digital Re-imagination of Customer`s claims Journey post a Catastrophe equipped by Phy-digital channels, AI Voice/Chat, Geo-spatial AI and Gen AI. Simplify the loss notification, damage report collection and settlement process. Aid the Insured with meaningful contextualized advisory during pre and post loss situations related to Insurance. This improves customer satisfaction and most likely the Insured continue to stay with the Insurer after such a claims journey.

TCS offers various Geo-spatial Information services and solutions such as Spatial analytics, Disaster prediction, Workforce Management, Smart city Services, Data services, Network asset Management, Utility Network Management Transformation across all major industries. TCS Ez Insure solution leverages deep learning algorithms for automated assessment based on satellite imagery and offers a virtual inspection mechanism for underwriters to remotely inspect the property. TCS Conversational AI solution builds machine learning models through guided flow from uploading data to pre-processing to building a model to testing and finally exposing as an API.

TCS is engaged with major Insurers in GIS Implementation, Underwriting, claims specific applications/ dashboards/ workflows development by configuring/ customizing base GIS Data and GIS Data Migration and Cloud Deployment. We believe that each Insurer`s IT landscape i.e.- the choice of technology, level of automation and customer touchpoints/channels are different. This requires the support of experienced integrator and consultants, who understand your business needs and to perform a complete assessment of As-Is and lay out the To-Be and develop Geo-spatial data and AI solutions with careful consideration of current underwriting, policy service, claim notification and adjudication landscape.