Industry

Solution

Highlights

- The mortgage industry processes a large volume of documents.

- However, indexing and extracting data from documents largely remains a manual process.

- Financial institutions can achieve improved efficiencies and productivity gains by leveraging TCS Automated Document Classification and Extraction Solution.

Overview

Mortgage industry requires extensive paperwork, documentation, and record-keeping as a part of its core processes. Yet, document digitization is still evolving in most organizations.

The mortgage industry is inching towards greater digitization, some progress has been made in moving away from paper-based processes, many organizations are still in the transition phase and full digital adoption is limited. Many operate in a hybrid environment, combining digital tools with paper-based methods. Some still rely on manual processing, especially in legacy systems.

Limited document digitization in the mortgage business processing can lead to several significant challenges such as incorrect data extraction, delays in processing borrower applications and potential impact in proper loan decisioning. Further, such data errors can lead to non-compliance with regulatory requirements, exposing the mortgage firm to legal risks and penalties. In summary, it hampers efficiency, increases costs, elevates risks, and diminishes the overall customer experience.

To help mortgage firms and financial institutions with the above concerns, TCS has created Automated Document Classification and Extraction solution. With a machine-human teaming model and cloud-first approach, the solution leverages machine learning (ML) algorithms to automatically classify and extract the data. It also leverages Generative AI to tackle data extraction from complex semi and unstructured documents. It ensures that data is organized from beginning of the borrower journey, thereby, improving operational efficiency and reducing cost.

Solution

TCS Automated Document Classification and Extraction blends modern technology with business context.

The solution utilizes traditional OCR for a part of document processing. It leverages machine learning in combination with advanced AI/GenAI technologies to mimic human cognitive abilities. It delivers document classification and data extraction of Mortgage documents across the value chain. The solution enables the integration with upstream and downstream solutions to create straight through processing.

Core technologies that are part of the solution include: OCR, Artificial intelligence (AI), Machine learning (ML), GenAI, and computer vision.

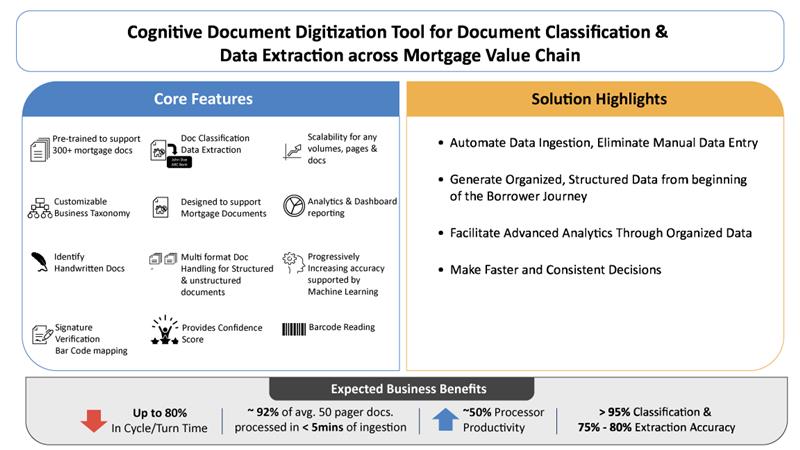

TCS Automated Document Classification and Extraction provides a range of features:

Document Classification - The solution applies ML capabilities to identify individual documents from a loan package and classify the same. It handles the variation in structure of the documents for classifying them according to type.

Data Extraction - Using rule sets tied to classification, the solution auto-extracts data from the document. These rules can differ and vary according to each document. This data can then be routed to multiple destinations such as LOS or a repository.

Validation/Exceptions – The tool integrates confidence scores from OCR, machine learning and business taxonomy to identify missing pages and low-quality data.

Pre-trained model – The solution is pre-trained on 300+ unique mortgage structured & unstructured documents.

Business benefits

The solution can help lenders and mortgage service providers to achieve data automation, enhance data accuracy, streamline compliance and reduce human dependency.

Some of the benefits include:

Accelerated Processing - Digitize documents and extract relevant information using machine learning, and contextualize the data based on your firm’s business rules. Improve processing speed - ~92% of avg. 50 pager documents processed in less than 5 mins of ingestion.

Improved Efficiency - Ensure minimal human intervention, freeing employees’ time for business-critical work. Achieve faster response times, better customer service, and increased revenue.

Reduced Cost - Eliminate manual indexing and extraction and reduce the associated overhead costs. Achieve ~50% improvement in processor productivity.

Data Integrity and Data Quality - Reduce the risk associated with poor data entry, while increasing the speed at which tasks can be carried out. Realize > 95% Classification and > 80% Extraction Accuracy

Consistent Quality Decisions - Accuracy of the input data and the application of a standardized business taxonomy ensures high quality decisions.

Faster Turnaround Time - Improve ROI with GenAI capabilities. Up to 80% reduction in Cycle/Turn Time.

TCS Advantage

TCS brings decades of experience and deep contextual domain knowledge to the table.

TCS has a large global team of mortgage professionals who work across all segments of the housing finance industry with customers across the globe. The team provides full spectrum services from advisory, prototyping, engineering, business process services and digital solutions to the mortgage industry.

- Domain and Technology Expertise: With over two decades of experience in mortgages and home lending, we have developed deep domain knowledge and expertise across the value chain. Our offerings & solutions are reinforced by a large pool of contextual experts with well-established IT capabilities stemming from being one of the largest providers of IT & business solutions globally.

- Delivery Excellence: We offer flexible, scalable, and convenient engagement models, with a massive delivery center footprint, allowing clients to enjoy access to geo-specific language capabilities and a comprehensive understanding of local regulations.

- Experienced Transformation Professionals: TCS has balanced delivery presence in established and emerging economies such as US, UK, Europe, Latin America, and Asia supporting diverse portfolio of clients, comprising of large banks, non-banks, mortgage servicers, credit unions, mortgage insurance company and fintech.

- Industry Leader: TCS has been consistently ranked as a leader vis-à-vis its peers by industry analysts. Our robust capabilities in implementing and running large scale mortgage operations with a focus on delivering digital technology-enabled operations reflect in our long-term engagements.