Industry

HIGHLIGHTS

- The advent of GenAI has expanded the capabilities of AI with the potential for further differentiation to banking, financial services, and insurance value chains, driving significant efficiencies and experiences for firms.

- All AI-driven decisions and recommendations must have an appropriate level of validation and transparency, with regulatory, compliance, and data privacy requirements factored in at the earliest stages of development.

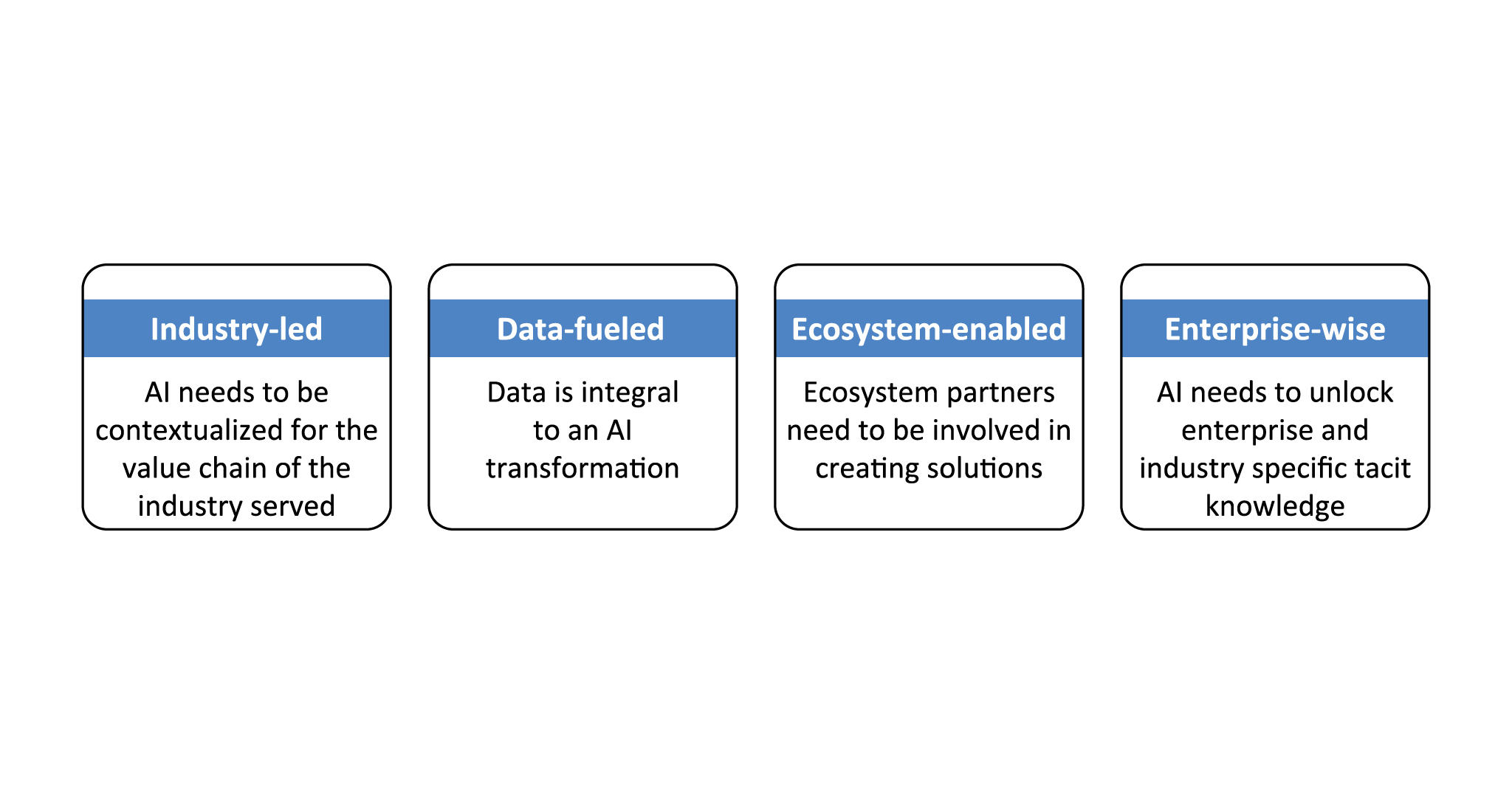

- Built on the principles of an industry-led, data-fueled, and ecosystem-enabled foundation, we propose an enterprise-wise AI approach designed to make AI consumable for an enterprise-grade transformation.

On this page

The transformative potential of AI

Many banking, financial services, and insurance (BFSI) organizations are already extensively experimenting with AI technologies.

In the TCS 2023 Global Cloud Study, an astonishing 82% of BFSI respondents said they increased investments in artificial intelligence (AI) and/or machine learning (ML) in the past one to two years. An even more astonishing 87% said they planned to invest in AI-ML in the next one to two years.

Since the moment generative artificial intelligence (GenAI) went mainstream, organizations have grappled with the best way to realize its vast potential. BFSI firms have traditionally embraced analytics while being heavily guard-railed by compliance and regulations, and the effect is visible in the way AI has been used thus far.

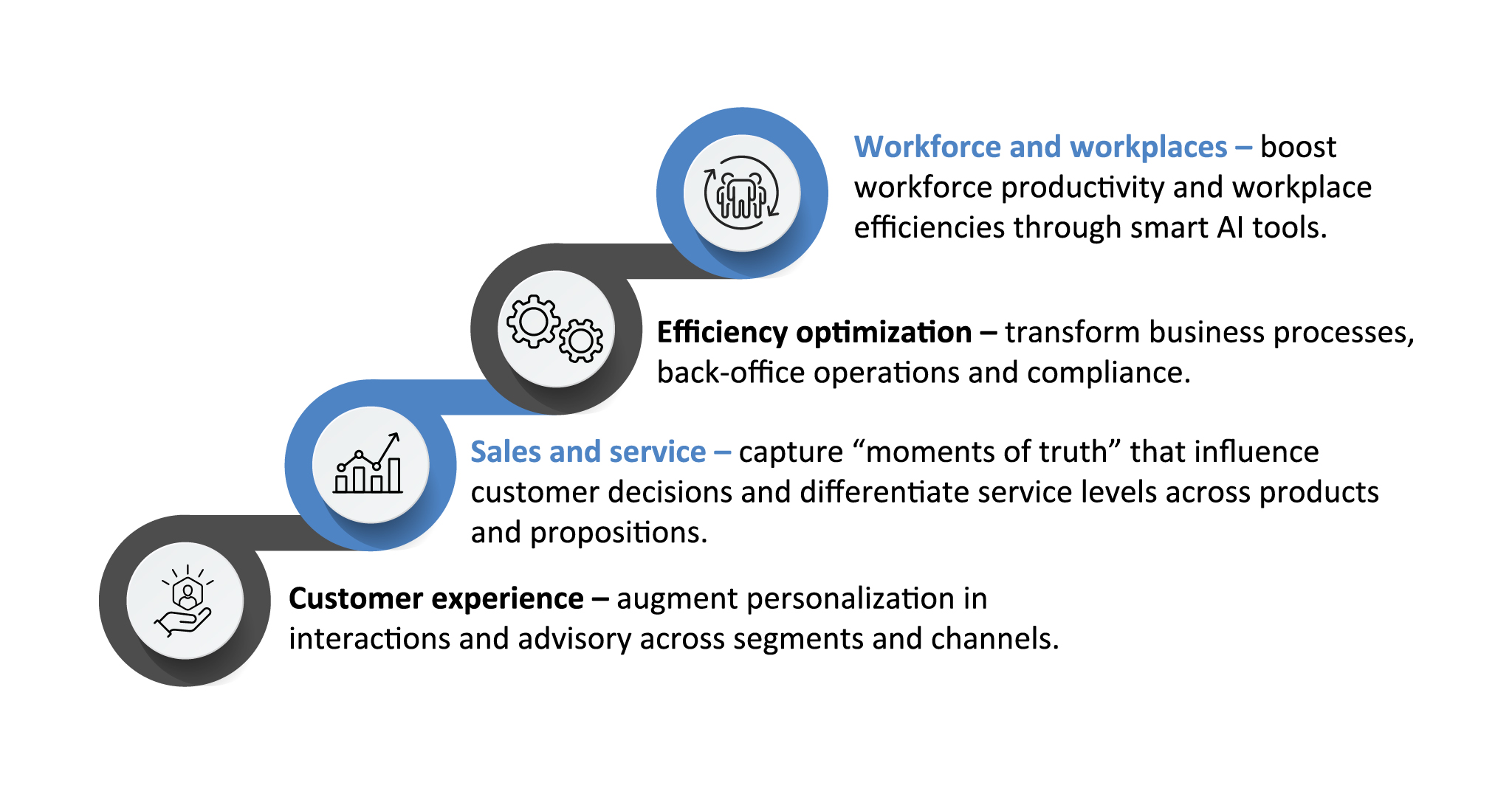

Over the last four to five years, predictive AI, with its expressive modelling capabilities, has been leveraged as an alternative to traditional analytical models. The advent of GenAI has further expanded the capabilities of AI with the potential for transformational impact. For BFSI firms, the opportunities are tremendous (see Figure 1), including:

- Customer experience: Augment personalization in interactions and advisory across segments and channels.

- Sales and service: Capture ’moments of truth’ that influence customer decisions and differentiate service levels across products and propositions.

- Efficiency optimization: Transform business processes, back-office operations, and compliance.

- Workforce and workplaces: Boost workforce productivity and workplace efficiencies through smart AI tools.

AI adoption and opportunities in BFSI

AI transformation will impact value chains across virtually all BFSI lines of business.

We studied GenAI initiatives across BFSI firms to understand adoption maturity and business potential. While the implementations are either in the pilot or planning phase, the objectives can be classified into two broad categories—enhancing customer experience and improving operational efficiency.

Areas such as virtual assistance, process streamlining, and personalized service saw the highest number of pilot or planned initiatives, followed by decision accuracy, fraud detection, automated financial advisory, and compliance. Most of the implementations are at an experimental stage with varying degrees of adoption maturity. Significant business potential is seen in process streamlining, personalized service, automated financial advisory, and compliance monitoring.

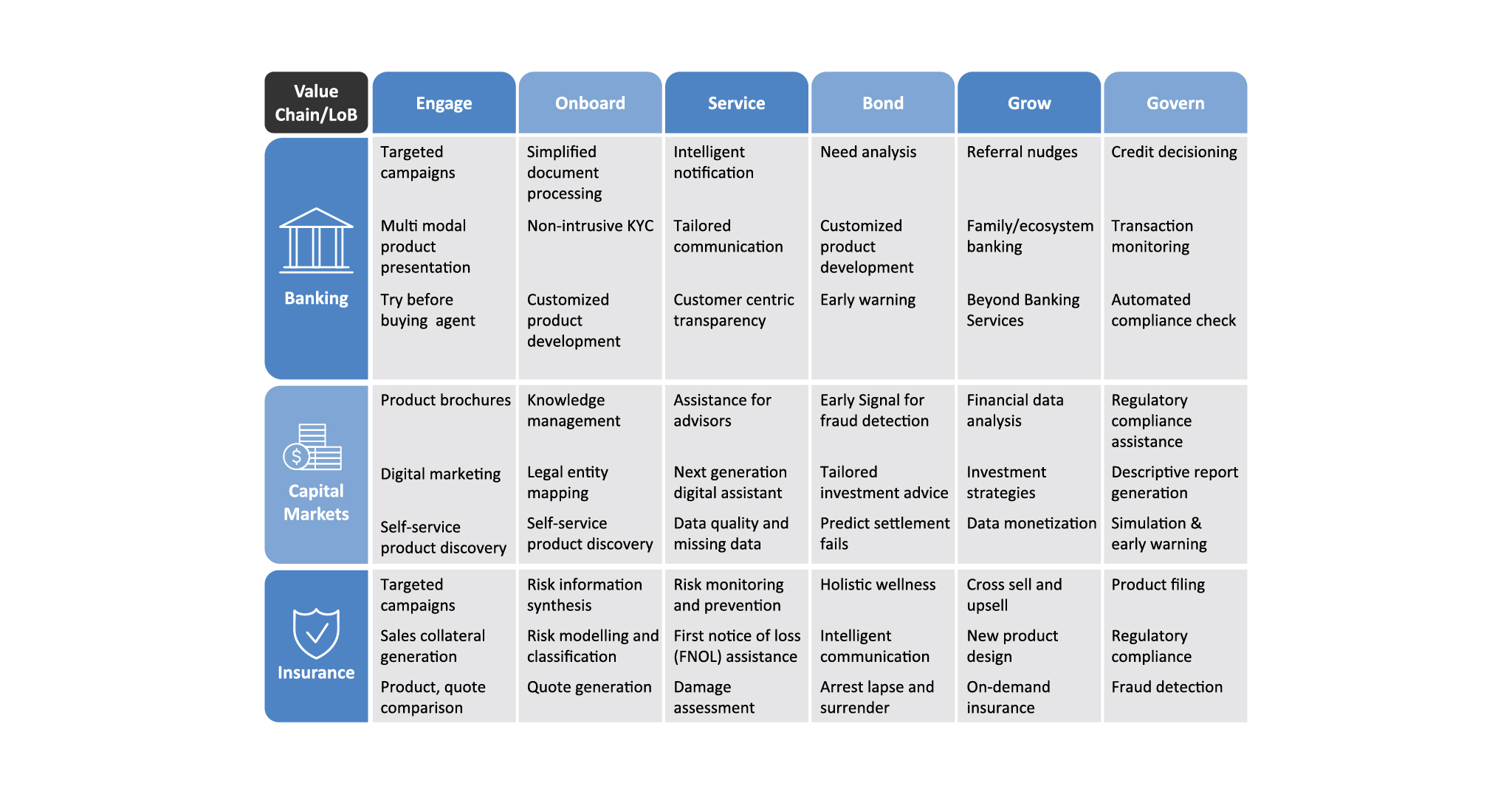

We further evaluated the value chains across the banking, capital markets, and insurance lines of business (LoBs) to identify granular impact areas (see Table 1). For every LoB, both predictive and generative AI will have varying degrees of influence on business outcomes–from initial engagement to onboarding and servicing, and from bonding to growing and governing. The impact could be change, simplification, or complete reimagination.

The banking value chain lends itself to the transformational impact by AI. With increasing GenAI adoption, financial institutions will be able go beyond standalone interventions and intersperse AI into the larger banking value streams and customer journeys. AI-infused capabilities like hyper-personalized campaigns, non-intrusive KYC, advanced needs analysis, and so on, will significantly enrich customer experience and engagement.

In capital markets, a combination of AI and GenAI will bring in new capabilities such as knowledge management, content mining, summarization, content generation, and synthetic data creation. These capabilities can be leveraged to enhance customer experience and transform business models.

Digital progress is steadily transforming business processes and client interactions in insurance. AI adoption will further accelerate the transformational impact. Large language models (LLMs) have the potential to transform the insurance value chain–from helping agents and brokers to underwriters and claim handlers. Process transformation is one of the biggest benefits for carriers.

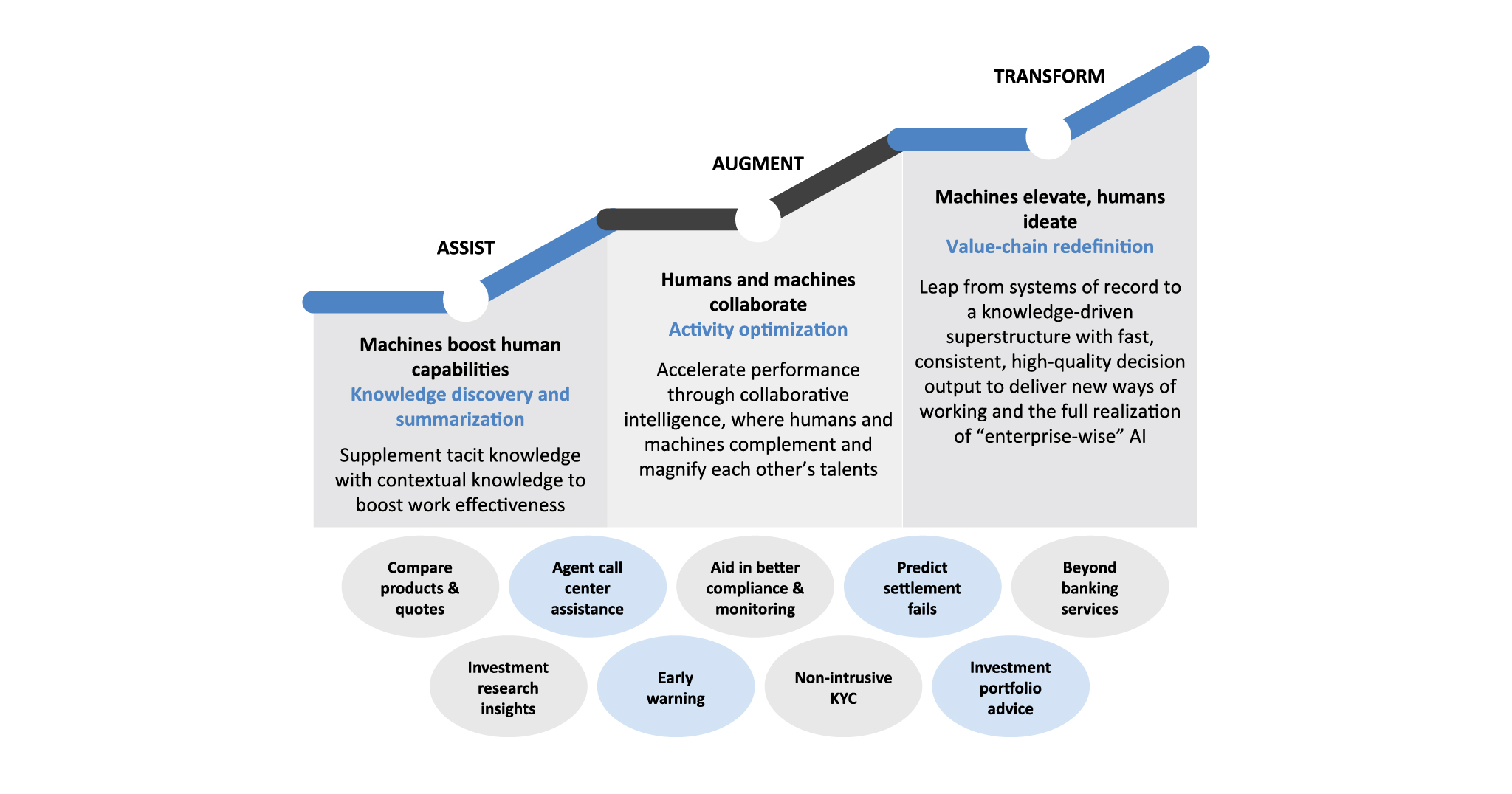

It is important to note that in all of these impact areas, intelligent technologies are a copilot for humans, not a replacement. AI will augment humans in their day-to-day work, empowering them to make consistently better decisions and truly innovate in a way that transforms the entire organization.

Our GenAI vision – the continuum

AI is already a key transformative technology for BFSI firms.

Strategic investments in cloud, advanced data management infrastructures and specialized AI applications over the last decade have paved the way for the next wave of transformation for BFSI organizations. But they must now go further to turn the full potential of predictive and generative AI into sustained performance.

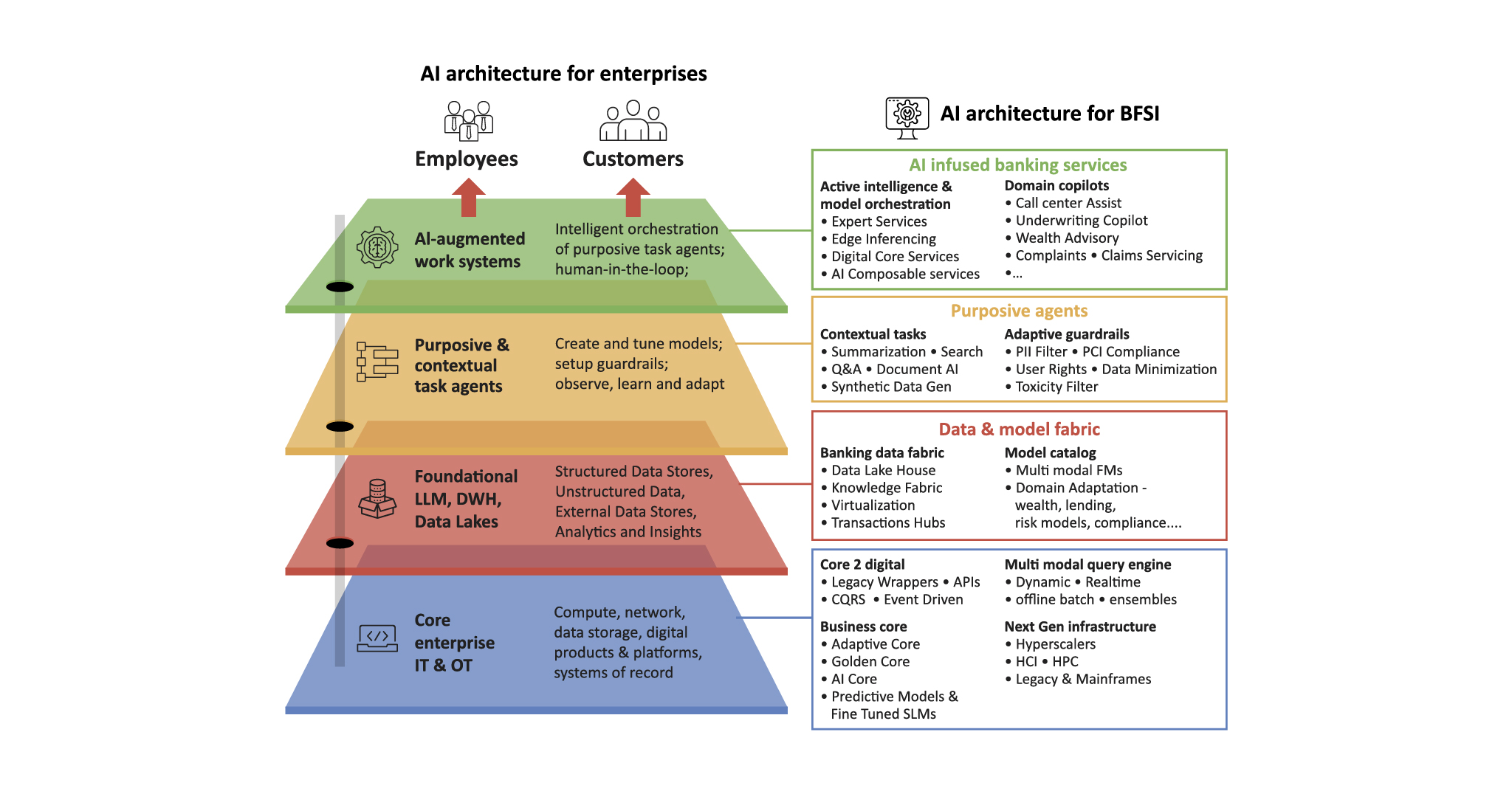

Built on the principles of an industry-led, data-fueled, and ecosystem-enabled foundation, we offer an ‘enterprise-wise’ AI approach designed to make AI consumable for an enterprise-grade transformation (see Figure 2).

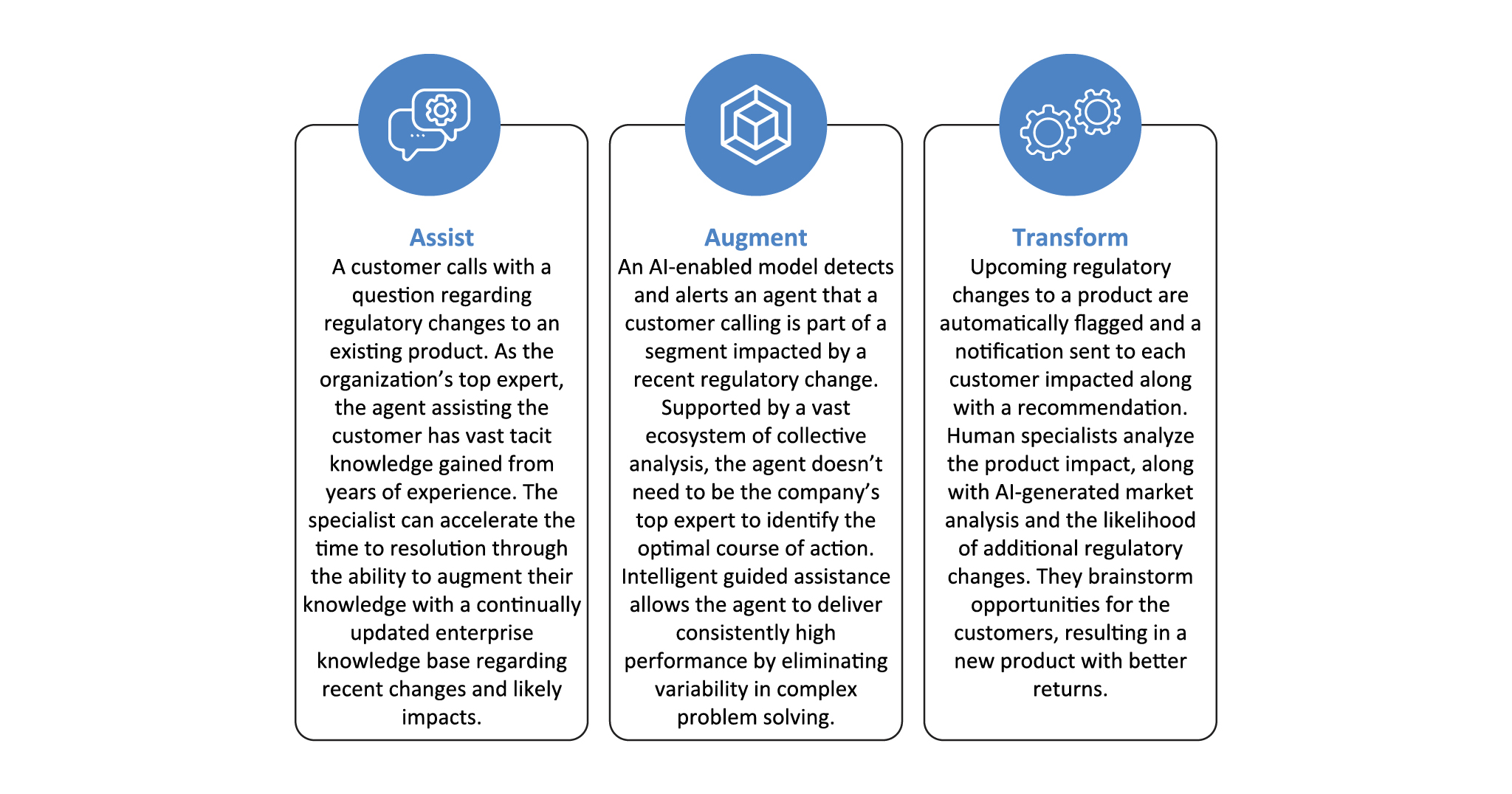

These four principles underpin our approach to converting AI potential to performance–a continuum that builds upon and reinforces each stage: assist, augment, transform (see Figures 3 and 4).

Navigating the complexity

A fundamental tenet of the finance industry is trust–and this must form the basis of an AI revolution.

All AI-driven decisions and recommendations must have an appropriate level of validation and transparency. In addition, BFSI organizations have unique regulatory, compliance and data privacy requirements across different geographies, which must be factored in during the initial stages of developing an AI model.

Finally, it can be challenging to develop a robust business case when it’s difficult to quantify the business benefits and costs of AI. Any AI solution must start with a value-augmentation opportunity for the business; prioritizing top-down structures, rather than starting with technology adoption.

We believe BFSI firms must recalibrate their enterprise architecture for AI considerations (see Figure 5):

- Infuse AI-led assist and augment capabilities into business processes and customer journeys

- Adopt data- and integration-intensive polyglot architecture for building AI applications

- Incorporate fit-for-purpose predictive AI capabilities into the business core

- Adopt human-in-the-loop oriented process design for verification and validation

Set up enterprise-wide guardrails in alignment with ethical guidelines

Using the existing enterprise IT systems as a foundation, the multi-layered AI architecture adds layers including foundational LLMs, data lakes and external data stores. Purposive and contextual AI task agents sit on top of this layer, and the final layer adds AI-augmented work systems working in partnership with human employees.

Transforming end-to-end value chains

AI is set to become mainstream in the BFSI industry, especially given GenAI’s potential to add complementary value.

Fueled by data, the AI enterprise of the future is an operative intelligence that partners with humans to go beyond productivity improvements. The scope for transformative business value creation through knowledge driven decision making, elite performance, and greater innovation, is immense once adoption scales.

Reimagining ways of working and augmenting humans with advanced knowledge capabilities can transform tacit knowledge into elite decision-making and high-performing innovation superstructures. We believe that a medium to long-term strategy that considers structure, business models, ecosystem partnerships, and ways of engagement with adequate emphasis on explainability, ethics, and governance will be key to large scale AI adoption in the BFSI industry.

The TCS advantage

TCS partnerships help BFSI organizations successfully navigate GenAI transformations to drive sustained performance.

Deep domain and contextual expertise: TCS has well-established product and enterprise knowledge and technological expertise across the BFSI value chain to enable robust AI applications and ongoing support.

Cross-industry experience: Working with customers across industries such as travel and transportation, retail and manufacturing brings an end-to-end holistic view of enterprise business functions and knowhow.

Research and innovation focus: TCS collaborates with global academia across AI research areas such as advanced NLP, behaviour modelling, and quantum computing. We also collaborate on BFSI-centric impact areas like enterprise digital twin, portfolio optimization, and automated regulatory compliance. Our hyperscaler partnerships, extensive TCS COIN™ network, and co-innovation facilities such as TCS Pace Port™ help us accelerate the path to value.

Enterprise AI at scale: Our 3P strategy–patents, products, and platforms –and more than 150,000 trained associates help us enable enterprise AI at scale.

Evolving areas of capabilities: TCS is infusing predictive and GenAI interventions to assist and augment existing value streams.

- Smart contact center: Transform contact center customer experience through a GenAI-enabled agent copilot for real-time call guidance and monitoring.

- Smart financial analysis: Deliver AI-powered conversational agents to generate smart insights in business vernacular that drive intelligent business decisions.

- Intelligent claims process: Enable frictionless claims and reporting processes across the claims journey by deploying AI-powered conversational agents.

- Complaints management: Classify, route, and swiftly resolve complaints through AI-driven complaints management.

- Advanced quant analytics: Transform underwriting and portfolio management through a suite of solutions that combine deep business domain expertise with advanced analytics, design thinking, and next-gen tools and frameworks.

- Advisory offerings: Enhance revenue generation and improve efficiency through a range of AI-led offerings tailored to a complete spectrum of stakeholders across BFSI organizations.

EXECUTIVE CHAMPIONS

Susheel Vasudevan

President and Business Head, BFSI – Americas, TCS

Siva Ganesan

Senior Vice President and Head, AI.Cloud, TCS

Babu Unnikrishnan

Chief Technology Officer, BFSI - Americas, TCS

Shankar Narayanan

President & Business Head, BFSI – UK, EMEA & APAC, TCS

Nidhi Srivastava

Vice President and Head of Offerings, AI.Cloud, TCS

S. Baskar

Head, Open Finance, BFSI, TCS