Industry

Highlights

- The software-defined vehicle is bringing a paradigm shift in the way automotive industry does business today. The transition would require a fundamental shift across products, processes, technology, and people.

- Product governance must be embedded throughout the vehicle lifecycle, ensuring alignment with evolving business needs. To stay competitive, enterprises must adapt their processes, technology landscape, and partner engagement models to the rapidly changing automotive ecosystem.

- The SDV-led transformation is revolutionary and may call for redefining the DNA of an organization.

On this page

A paradigm shift

For over a century, the automotive industry has revolved around mechanical innovation, with software playing a secondary role.

That balance is shifting.

The software-defined vehicle (SDV) is bringing a paradigm shift in the way the automotive industry does business today. It is not merely a vehicle technology stack upgrade–it is a multidimensional change in the enterprise business and operating model. The true potential of SDV can only be realized if the enterprise transforms itself to adapt to the changing business needs and leads to product innovation.

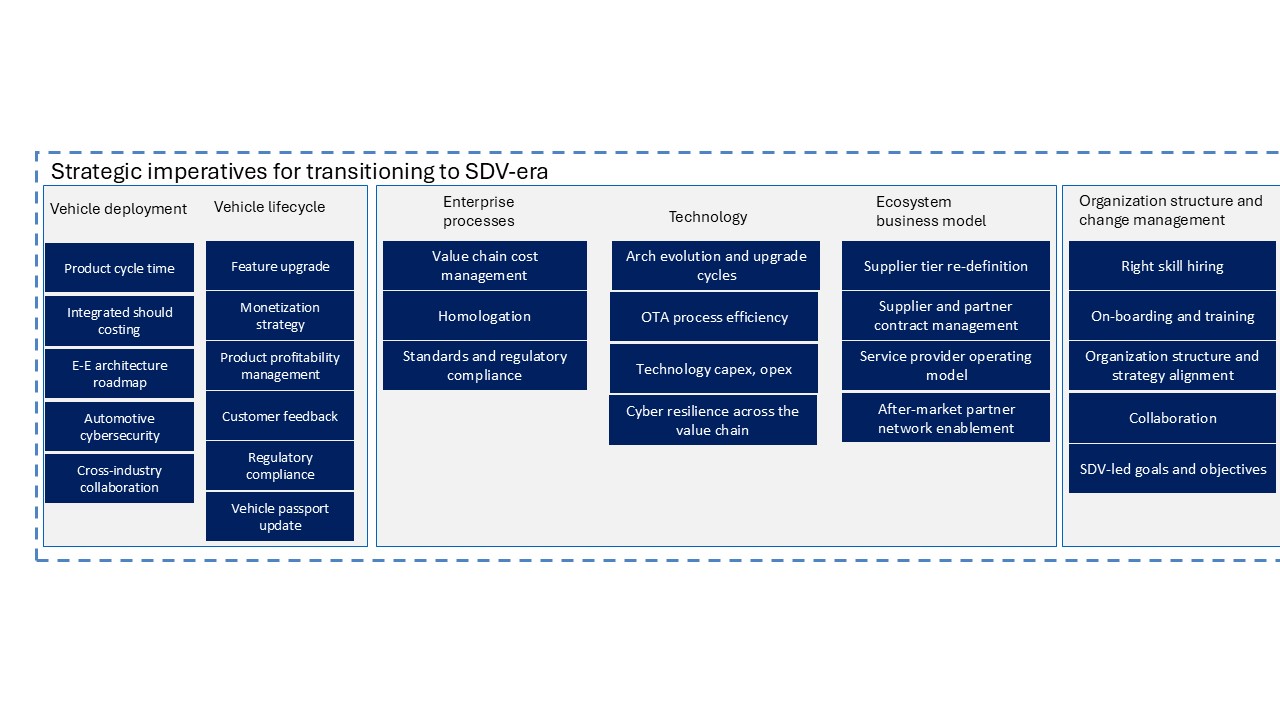

Aspects of automotive business across products, processes, technology, and people need to change. Original equipment manufacturers (OEMs) undergoing SDV-led transformation need to relook at the internal operating structures and calibrate the influence of third parties involving partners, ecosystem players, and regulatory bodies in their strategies. Figure 1 illustrates an overarching framework for embracing this transformation:

SDV-led business transformation requires significant investment. Therefore, a well-defined and executed governance model is recommended to ensure the objectives are met, and ROI is faster.

We discuss the key aspects of governance guardrails that will drive the success for SDV adoption.

Product lifecycle

Governance process should be embedded throughout the product lifecycle – from the cradle to the grave, literally.

The following aspects must be tracked and monitored during vehicle development, maintenance over a lifetime, and end-of-life management.

- Vehicle development:

Product development cycle optimization: Monitor and streamline development timelines, leveraging software and hardware decoupling alongside virtualization technologies to shorten the time to market.

Comprehensive cost analysis: Integrate a should-cost analysis that includes both hardware and software components. The impact of SDV on product cost includes benefits from zonal architecture, a reduced number of electronic control units and associated wiring harnesses, virtualization, and physical infrastructure sharing, a simplified testing process in vehicle production, and provisioning more hardware capacity upfront.

Electrical and electronic architecture upgrade roadmap: When blueprinting their technology roadmap, organizations must factor in that an evolving business needs alignment and tracking of how the underpinning technology adheres to future-proof business.

Hyundai, for example, detailed out a plan to leverage SDV architecture, underpinning differentiated business services around enhanced driver safety, automated driving services, generative AI-led advanced, mobility assistants, and smart ecosystem integration services as part of CES 2024.

Future proofing automotive cybersecurity: Develop a long-term cybersecurity strategy to future-proof products and processes. Embed practices such as security by design, add layered security to ensure depth in defense, continuously review published information on attacks, threat analysis, and risk assessment with automation, and embrace the standards and best practices like ISO 21434, UNR 155, and NHTSA.

Cross-industry collaboration: Participate in consortiums like SOAFEE, COVESA, and Eclipse Foundation and value their impact on product quality and time to market.

- Vehicle maintenance and lifecycle management:

Periodic upgrades as designed: Ensure periodic and timely software feature upgrades within the constraints of vehicle hardware to maintain a competitive edge.

New feature monetization strategy: Maintain a systematic process to determine monetizable features vs. non-monetizable value-added features. As an example, Tesla continues to increase its share of services revenue driving sustainable growth.

Product profitability management: Continuously assess the cost-revenue balance throughout the vehicle's lifespan, addressing software recalls and warranty claims associated with SDV technologies.

Customer feedback management: Develop robust mechanisms to collect and analyze data from customers and vehicles, utilizing telematics and sensor information and closing the feedback loop throughout the ownership lifecycle of vehicle.

- Vehicle end-of-life:

Regulatory compliance: Leverage SDV-enabled data and information fabric for compliance and reporting.

End-of-life track and trace: Implement systems for tracking vehicles through their lifecycle stages, facilitating data sharing among partners to support compliance and sustainability initiatives. Extended producer responsibility fees optimization and stakeholder value reporting requires strategies to manage the lifecycle of automobiles, including waste collection, recycling, and disposal.

Vehicle passport update: A streamlined process and secure infrastructure for data sharing among partners and suppliers will enable regulatory and compliance reporting. For example, BMW is leading a consortium to lay the foundations for a circular economy in automotive manufacturing.

Processes and technology

The enterprise processes, technology landscape, and partner engagement model must be reimagined and adapted to the changing business needs.

Automotive OEMs must cultivate the capabilities to manage technical complexity through co-development, platform integration, and leveraging regional and global partners.

- Enterprise processes: As the capability footprint evolves to be more software-centric, traditional processes must be redesigned to align with the needs. These are categorized as:

Value chain cost management: Adopt measures to track and optimize SDV-led software and hardware cost buckets, which include open-source stack leverage, right fit sizing of vehicle compute infrastructure, and cloud and network connectivity services.

Homologation: Document the software update details of electronic control units to ensure re-homologation needs are tracked and OBD (onboard diagnostics) and non-OBD applications are separated.

Standards and regulatory compliance: Ensure compliance with numerous existing and upcoming regulations, such as ISO 26262, TISAX, Automotive SPICE, IEC 61508, ISO-SAE 21434, UNECE R155, and ASIL.

- Technology provides the core underpinnings for the SDV-led transformation spread across the evolved hardware and software stacks. Hence, a refreshed governance approach is needed. These are categorized as:

Technology upgrades for the product platform and enterprise systems: Increased hardware abstraction and shift-north controls enable a wider development ecosystem. The product and enterprise technology platform are aligned with the business roadmap.

Technology total cost of ownership (TCO): A TCO framework must include measures to bring efficiencies in onboard hardware and software pricing and deployment processes.

Cyber resilience across the value chain: Security controls across the value chain, including suppliers, ecosystem service providers, and enterprise services with a secure on-board communication channel are crucial.

Over-the-air process efficiency and effectiveness: Manage KPIs such as release cycles, deployment efficacy, and change failure rates, which demonstrate the efficacy of over-the-air cycles. Example, Ford has emerged as a leader in over-the-air services, offering a partitioning approach that can perform a silent upgrade without impacting vehicle operations.

- Evolving ecosystem business model

SDV business models drive significant value from the ecosystem in which they operate. Dependencies span the entire value chain, necessitating strategic interventions to drive the paradigm shift. These shifts are categorized as:

- Supplier tier redefinition: Shifting supplier landscape with the emergence of tier 0.5, repositioning of tier 1s, and new technology partners require explicit engagement models and governance while having a strategic long-term commitment from automotive OEMs. To illustrate, NVIDIA, the leading global chip manufacturer and provider, has partnered with JLR, Mercedes, and many others to provide the onboard compute infrastructure to roll out autonomous driving services with a committed continued collaboration on technology.

- Supplier and partner contract management: Different contractual agreements such as revenue sharing, micropayments, and other joint arrangements, are used to simplify and scale rolling out software updates.

- Operating models with service providers in the ecosystem: Effective partnerships with key ecosystem service providers such as charging stations, smart city infrastructure, retail, and hospitality services are critical for seamless SDV operations.

- After-sales and service partner network enablement: Enhancing after-sales support involves collecting diagnostic information from vehicles and sharing it with service partners, software upgrade cycles from vendors, and commercial arrangements.

The people in the organization and ecosystem

The SDV-led transformation is revolutionary and may lead to redefining an organization’s DNA.

Ultimately, the SDV transition is not just a technological evolution—it is a cultural shift. For automakers accustomed to selling hardware, moving to a software-first approach requires a different mindset. This means investing in new talent, fostering partnerships with technology firms, and rethinking product life cycles.

Therefore, an extensive governance framework is required to ensure the change is accepted across the organization's levels and by its extended ecosystem partners. The steps below can smoothen the process.

- New and existing employees

- Proper skill hiring: SDV-relevant skills with a strategy to converge toward a unified technology stack

- New employee onboarding: Alignment with the organization's agile operating model and business processes

- Training and upskilling: Necessary skill upgrades as the organization transitions from a mechanical to a software-driven approach

- Organization change management

- Strategy alignment: Communication and training are critical components in aligning people toward evolved business success metrics, service offerings, customer focus, and operations.

- Organization structure: In lieu of realignment, changes are required to the operating structures. Organizational architecture should have a combination of stable functional hierarchy while some functions need to have networked structure for faster response to market requirements.

- Collaboration: There should be integrated ways of working for business units across engineering, manufacturing, marketing and sales, IT operations.

- Goals and objectives: KRAs must be revamped to deliver optimal SDV-driven outcomes.

For example, Ford believes the SDV shift requires a rewriting of the brain. On similar lines, Volvo considers commercial vehicle makers need to implement a significant cultural change if they want their SDV journey to succeed.

- Partners and suppliers

- Partners and suppliers' maturity assessment: Build a continuously monitored process to ensure suppliers and partners are not the weak link while the automotive OEM progresses forward. Their continued commitment to investing in technology and business processes is necessary.

- Regulatory compliance: Automotive OEMs need to ensure that their partners and suppliers comply with policy and regulatory requirements.

- Value delivery: Develop a unified value realization model with partners and suppliers, including shared risks and liabilities and financial incentives in line with top-line revenue growth.

Rivian and Volkswagen Group are forming a joint venture to develop next-generation SDV platforms for both companies. The objective is to combine their complementary strengths and lower vehicle costs by increasing scale and speeding innovation.

A foundation to build upon

The transition to software-defined vehicles is inevitable.

The objective for OEMs is to improve topline and profitability while creating more value for the customer. This cannot be achieved without being guided by a systematic all-round transition process.

The framework proposed here will help automotive OEMs stay on top of the key imperatives, avoid pitfalls, and fast-track transitioning to the software-defined vehicle era. It should be considered foundational and further refined based on the specific business needs and current maturity of the OEM.