Industry

Highlights

- Industrial manufacturers are seeing a significant growth in connected products and are increasingly investing in digital platforms. This trend unlocks opportunities for data monetization and underscores a shift to subscription services to unlock new revenue streams.

- Adopting a subscription-based business model needs a holistic approach that focuses on the go-to-market strategy, financial modeling, and conversion strategies for appropriate channel partner enablement.

- Success in this business is predicated on a robust reorganization of team goals and KPIs that focus on customer success and relies on data-driven platforms that enable customer outcomes.

On this page

The shift to the ARR model

As the industry transitions to increased electrification, decarbonization, and net zero goals, manufacturers sharpen their focus on enabling sustainable outcomes, which remains high priority for growth.

On this journey, industrial manufacturers can access a plethora of data from connected products, enabling them to understand product performance and usage patterns. Many leading manufacturers invest in digital products that enable them to not just sell hardware but also software solutions that improve uptime and increase product performance, delivering better value. The early adopters sold these software products either complimentary to the hardware products or on a perpetual license basis.

With increased adoption of AI technologies and improved asset insights, manufacturers can go beyond offering dashboards to enable true business outcomes for their customers. Industry examples include connected building capabilities for optimized building performance, increasing plant efficiency through smart plants, improving data center performance, and sustainable mining operations, to name a few.

However, most manufacturers grapple with the challenge of monetizing this outcome. To shift from perpetual to annual recurring revenue (ARR) model, industrial manufacturers across the globe are looking to reimagine their organization, sales team structure, and the entire lead-to-cash process. This new model necessitates a blue-sky thinking approach to defining strategic priorities, market positioning, value-based pricing, customer segmentation, and scalable architecture.

The opportunity here provides additional sources of non-linear growth and increased customer engagement. Leaders in this industry are already on this journey and revenue from digital solutions are now a significant part of the overall revenue.

Building a robust subscription business

Manufacturers must consider various dimensions while building a subscription business.

The B2B SaaS transformation journey is essentially rooted in a customer-centric go-to-market strategy, which necessitates organization-wide change comprising people’s mindset, business processes, and technology capabilities.

Of the many dimensions that industrial manufacturers must consider when building a robust subscription business, we believe these to have a significant impact–product strategy, financial modeling, operating model and go-to-market strategy, value based pricing, and various technology investments that can bring the transformation.

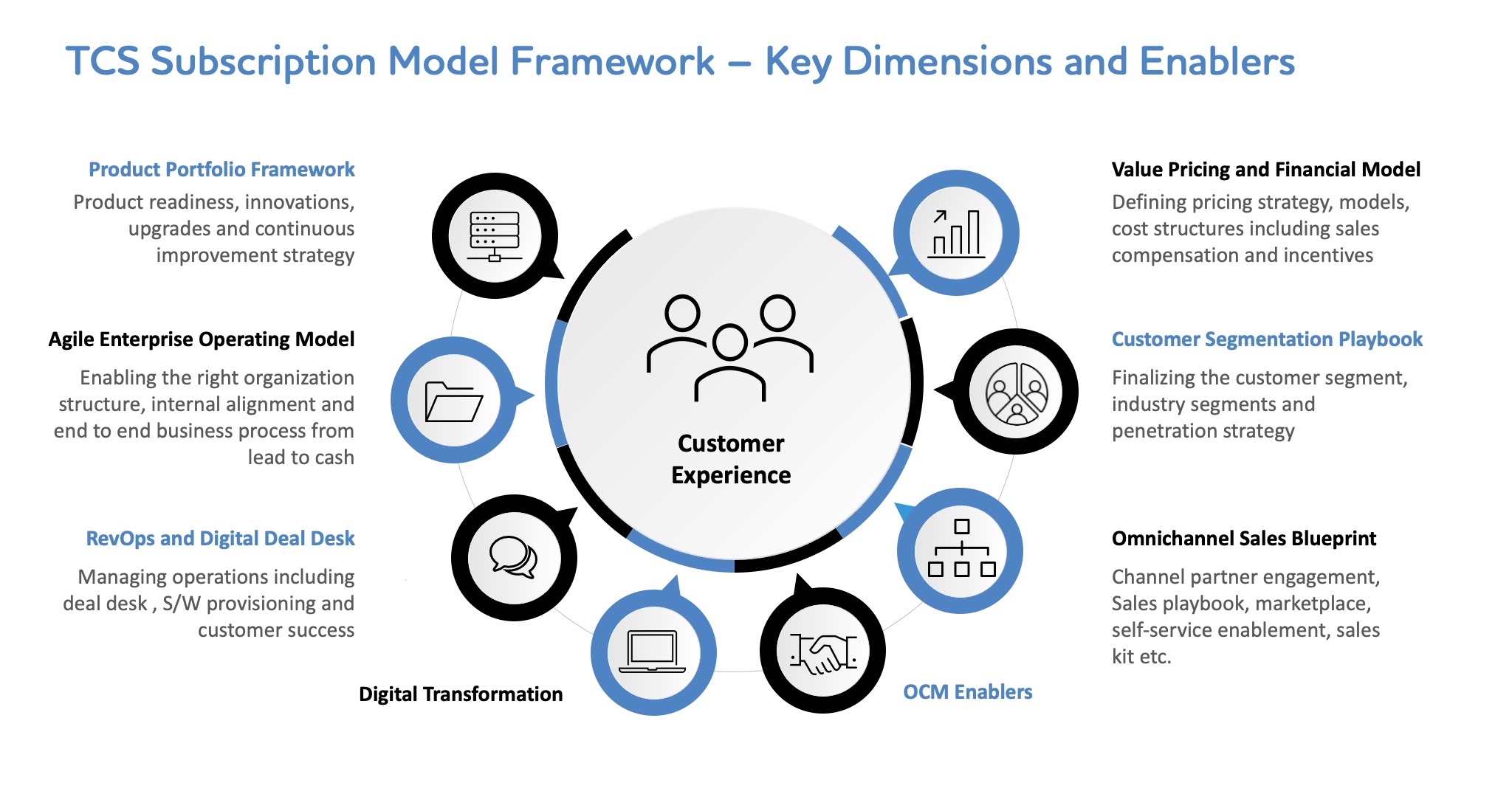

We propose a framework (see Figure 1) that would help manufacturers build a subscription business.

The key dimensions for a successful B2B SaaS transformation journey are:

This should be designed to balance growth, value, and differentiation. Key areas include customer-focused product catalog, analytics to monitor usage, continuous value delivery, readiness for SaaS infrastructure, bundling and offer development, and time-to-market.

This drives value, financial performance, and the return on investment (ROI). Value pricing strategies consider perceived value, competitiveness, market penetration, outcome, incentives and sales compensation. Simulation models factor in purchase scenarios, trade-offs (feature vs. price), and propensity models (to shift from trail / freemium to paid, retain, churn, and expand).

Tailored experiences and brand positioning are key to building a successful subscription business. The ‘segment of one’ strategy aims to market and deliver what matters most to each persona. Value-based segmentation helps drive customer success and premium services.

This would enable ease of doing business and ensure uniform experience for customers, partners, and ecosystem players. Customer-centric go-to-market sales tool kits (battle-cards, pitch days and roadshows, campaigns) will help internal sales teams and partners to drive contextual engagement.

with scalable architecture plays a critical role in customer engagement and conversion. This should include demo engineering labs for rapid prototyping, show and tell, and adopting emerging technologies (Agentic AI, blockchain) to continuously innovate.

This will enable business agility, rapid go-to-market, and customer centric innovation. It includes defining business operating models (structure, agile decision making, governance, among others), reimagined lead-to-cash cycle, solution engineering, cognitive customer service, and customer success.

Focused on culture, adoption, and mindset change, this involves leadership and stakeholder engagement and communications, customer engagement strategy, integrated planning across functions, organizational readiness and design, identifying change champions, and persona-centric training needs and delivery.

This will help maximize customer lifetime value and adopt healthy financial practices. Key aspects to consider are digital deal desk framework to enable traceability, accountability, and insights based faster decision making, software provisioning and enablement, potential to cross-sell and up-sell, collaborative planning and forecasting with customers (based on opportunities, renewals), and commercial insights (go-to-market and customer success performance metrics).

Innovative techniques for seamless adoption

A successful model can be enabled by addressing the typical barriers for change and the right articulation of the business value for all the stakeholders in the ecosystem.

When shifting to a subscription-based model, industrial manufacturers need to tackle the typical barriers to change and must articulate business value precisely. Identifying adoption barriers across people through the customer journey can help in developing effective mitigation strategies and driving seamless adoption.

Some of the challenges that we have observed over the course of working in the industry are:

- Migrating on-premises systems to the cloud remains a bottleneck along with legacy integrations

- The need to recalibrate investor expectations on short-term financials due to transitioning from upfront license fees to recurring revenue

- The fear of upfront revenue loss despite assured long-term revenue growth

- Losing customers to competition before breakeven points are reached

- The need to overhaul the marketing strategy to align to new pricing models

- Sales teams may be apprehensive of a reduction in their incentives and compensation

- Customers may want to pay only for the products and services that they’ll use

- Existing software environment may be highly customized and therefore cannot be used as-is

However, manufacturers can address some of these challenges through innovative measures. To accelerate SaaS adoption, businesses can collaborate with hyperscalers and reduce the one-time cloud migration cost for customers. Manufacturers can set up modular pricing (per production line tiers) to lower entry barriers. The ability to build ‘pilot-as-a-box’ solution and quick start solutions to demonstrate the RoI within 60 days using historical dashboards will help reduce perceived risks and address the initial concerns.

The RevOps strategy serves as a special purpose tool to streamline sales, customer success, pricing, and renewals. Some compelling digital tools would be: 1) guided selling enabled configure-price-quote with the ability to cross-sell and upsell to drive sales through channel partners, and 2) channels like digital marketplace to enable self-service.

To drive business value, developing a customer-centric sales strategy is the best bet while adopting a recurring revenue model. Product-centric strategies can lead to complex product bundling, perceived oversell, and lower adoption.

Let’s look at some opportunities and address value:

The primary opportunity here is revenue expansion and the delivery value for customers. The ability to analyze the voice of customers on an installed base to identify products with higher affinity toward subscriptions can drive focus on the right solutions. SKU rationalization based on customer personas and segmentation can help reduce design fatigue and streamline focus on high-value products.

The strategy should enable business outcomes – whether it is improved asset uptime or access to key operational insights that brings business efficiency gains. While the SaaS model will bring a shift from capital expenditure to operational costs, the business outcomes and the ability to work seamlessly with various ecosystem players within every customer landscape is paramount.

The strategy should improve customer retention, which in turn increases the lifetime value and is therefore a predictable revenue stream from the services point of view. This can provide cross-sell opportunities for partners, which include traditional products as well as new digital products that improve customer stickiness.

Winning in the next decade

The shift to subscription-based business model needs a holistic approach and opportunities for growth are immense.

Subscription model adoption will impact every business function and persona across customer journey, making it crucial to consider it for an enterprise-wide business transformation, cutting across the people-process-technology triad with a strong focus on change management. The subscription model is no longer optional for industrial manufacturers—it is a strategic imperative. It is a great way to improve customer stickiness and drive revenue growth.

Software providers have been operating in this model since many years and a few leading industrial manufacturers have adopted it in the past few years. By prioritizing modular innovation, ecosystem collaboration, and outcome-driven pricing, manufacturers can convert this opportunity into a strategic competitive advantage. The next decade will reward companies who embrace scalability, security, and sustainability—cornerstones of the subscription economy.