Industry

HIGHLIGHTS

- Despite the increasing focus on ESG reporting, the societal impact of ESG remains difficult to define, measure, and disclose.

- Modern ESG investors are keen to associate with retailers who demonstrate ‘impactful ESG’ by enabling social impact through their ESG investments.

- A data and AI-driven measurement framework provides a reliable tool for retailers to overcome challenges in measuring societal impact and a standardized way to represent a company's performance to modern ESG investors.

On this page

ESG priorities to create societal impact

Investors have long recognized the importance of social and governance factors of ESG on company reputation and valuation.

Despite the accelerated growth of ESG reporting, the ‘societal impact’ of ESG remains difficult to define, measure, and disclose.

Modern investors want to understand how retailers are impacting society with their ESG initiatives and are no longer just relying on backward-facing annual ESG reports.

Some key priorities for retailers looking to improve their overall ESG score and societal impact are:

- Responsible sourcing of products and services at each tier of their supply chain and procurement to support priorities like animal health and welfare, counterfeit-free and healthier food, sustainable farming and manufacturing

- Ethical business and fair labor practices within self and partner ecosystem

- Diversity, equality, and inclusion to build a fair and productive workspace by promoting empowerment, guard against discrimination, and creating skills and opportunities for all

- Health and safety in workplace to protect well-being of employees, customers, other stakeholders and building strong stakeholder relationships

- Community and partnership to support social cohesion, economic prosperity, and inclusive growth focusing on social return on investment

- Business models and technology framework for partner evaluation to avoid any negative impact on ESG rating and brand image

- Transparent reporting by incorporating social performance metrics alongside financial data

- Alignment with regulatory framework and global standards for ESG reporting

The advent of modern technologies like cloud, artificial intelligence (AI), blockchain can help draft a framework that can aid retailers in their effort to measure the societal impact of their ESG activities.

Key challenges for retailers in measuring societal impact of ESG initiatives

Societal impact measurement and reporting is the process of conveying the true social influence of a retailer’s ESG activities.

There is no one-size-fits-all approach to societal impact measurement. Historically, investors have relied on raw ESG data based on annual reports and ratings given by index providers; however, the focus is now shifting towards bringing in more transparency and accountability by blending raw ESG data with external influencers to measure impact-adjusted ESG score.

Approaches to evaluate data-driven ESG impact score is a complex task for all retailers due to following key challenges:

- Access to complete and reliable ESG dataset specially from external sources

- Identifying loose ends and violations within vast supply chain and partner ecosystem

- Changing social needs and regulations at regional level

- Big influence of social media on the brand image perception of investors and consumers

- No common framework or standards to measure ‘S’ in ESG.

- Building KPI (key performance indicators), models, and analytics to understand societal impact of ESG investments

- Quantifying risk-adjusted ESG scoring by blending social value with financial metrics

- Limited resources and expertise within self and partner ecosystem to quantify ‘S’

- Lack of ownership and awareness on social impact data collection

Without solving the foundational data and analytics gaps, retailers will not have an accurate understanding of their ESG impact score and will not be able to deliver reliable information to stakeholders. Therefore, ‘impactful ESG’ is best viewed as a collaborative ecosystem of new technologies, business models, and partnerships.

Building blocks

A framework that uses cloud technologies, blockchain, and Generative AI (GenAI) can help retailers reliably measure the societal impact of their ESG investments.

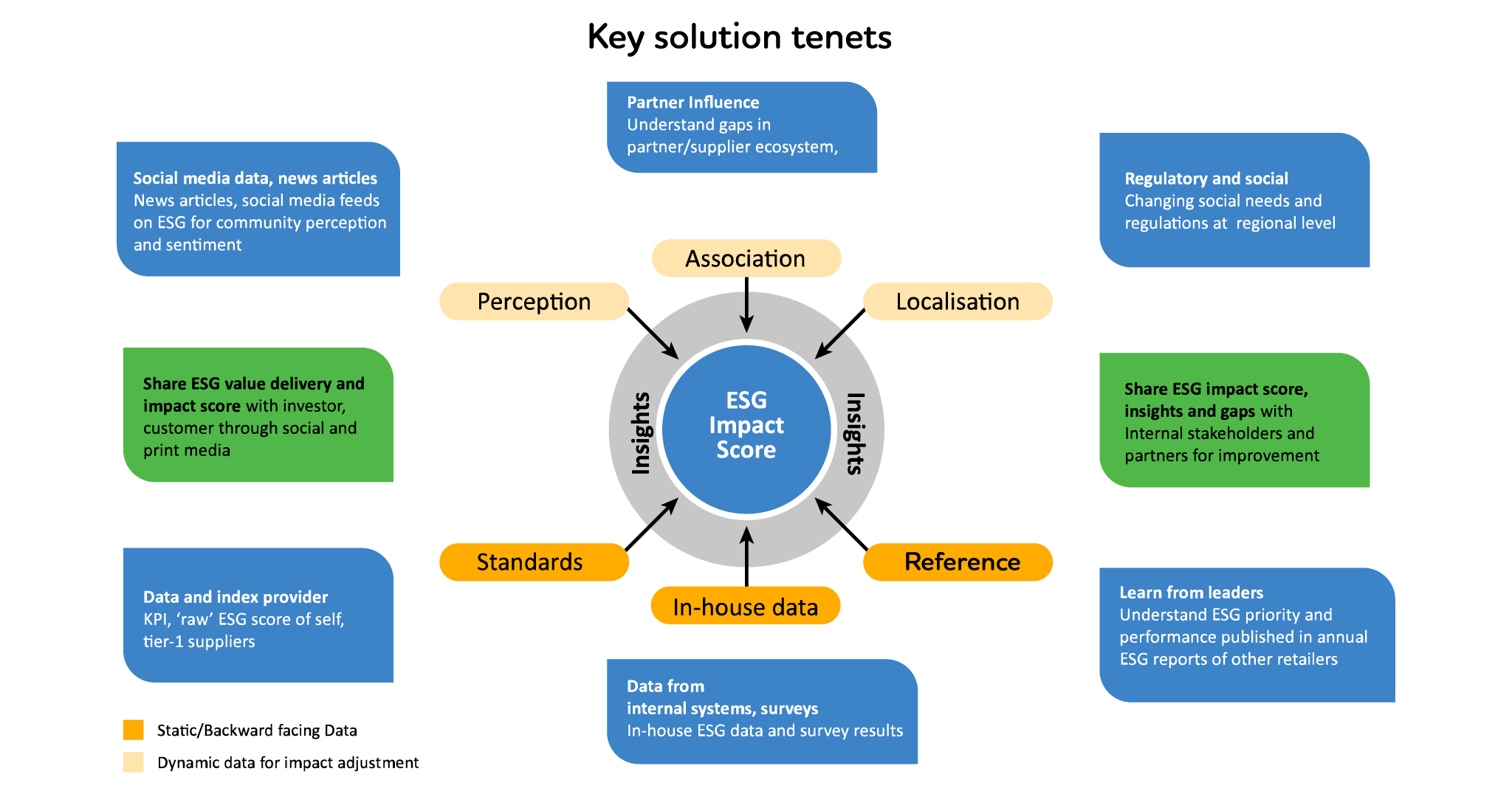

A framework that uses both static and dynamic data is critical to maximize the societal impact score (see Figure 1).

Creating a robust and reliable data foundation is critical for any analytical intervention, including societal impact measurement. To calculate the ESG impact score, both static and dynamic data are needed. Static data is collected from internal systems, internal surveys, annual reports and index providers, which is primarily associated with ESG raw score calculations and indexing. The true challenge lies in collecting dynamic data from social media, news articles, purpose global databases, and websites with local regulations. Once the data is cleaned, transformed, and stored in a central data fabric, the impact-adjusted ESG score can be calculated using pre-defined rules based on raw score, partner impact score, and customer sentiment score.

The KPIs that retailers report to measure ‘S’ in ESG include:

- range adherence percentage to RSPCA or equivalent assured certification in food products

- percentage of colleagues who say they can be themselves at work

- percentage of tier-1 suppliers who regard the retailer as a fair business partner

- percentage of senior leaders who are female, or from ethnic minority

- percentage of tier-1 suppliers with trade union representation and following fair labor practices.

- percentage of tier-1 suppliers with health and safety committees in place

- percentage of employees in brands, functions, markets trained in inclusion and diversity

- percentage of those offered an employment contract after completing work placement trainings

- percentage of beneficiaries who felt community-focused programs were useful

This framework enables data-driven insight on ESG raw vs impact score, sentiment score, partner influence score, and the effectiveness of ESG priorities. All these insights help retailers to take timely action on realigning their ESG strategies, partner selection, and media coverage in a proactive manner. This framework can be packaged and exposed to relevant stakeholders in the form of APIs, dashboards, and data products.

Data sources and techniques

Both static and dynamic data are required to calculate the impact-adjusted ESG score.

While static data sets the base for raw score, dynamic data helps quantify the impact adjustment to derive the final impact-adjusted ESG score.

The three main sources of static data are:

- In-house data: In-house ESG data is extracted from enterprise resource planning (ERP); human resources (HR); health, safety, and environment (HSE) and other internal IT systems based on critical data elements and key performance indicators (KPIs) used for annual ESG reporting. It also includes focused survey results on colleagues and partner satisfaction on fairness, skill upgrade, equality of opportunity, among others.

- Data and index providers: ESG data and index providers like fashion transparency index (FTI), workforce disclosure initiative (WDI), Sustainability Accounting Standards Board (SASB), and Sustainalytics, among others are involved with retailers and share index and insight into ESG performance based on pre-defined KPI and criteria. Data feed from data and index providers is captured and stored in the ESG data repository.

- Annual reports: Annual ESG reports allow retailers to communicate their commitment to sustainability and responsible business practices to stakeholders, including investors, customers, and regulators. Within this framework, shortlisted retailers and supplier ESG report links are stored and using web-scraping, summarization and topic modeling, social (‘S’) priorities and associated KPIs are captured. While summarization is done using GenAI solution, topic modeling, and trend detection can be done using conventional natural language processing (NLP) techniques like Bidirectional Encoder Representations from Transformers and Latent Dirichlet Allocation (BERT+LDA) or using LLM as part of GenAI solution.

The three main sources of dynamic data are:

- Social media for perception: Listening to customers’ feedback is key to understanding their sentiment about any retail brand, especially on ethics and contribution to society. Various social listening tools and techniques have already been used by retailers as part of their sales and marketing strategies. These tools can be extended to capture data from social media platforms for sentiment analysis and generating insights on societal impact.

- Global event database for association: Business ethics controversy, human rights violations by franchise, partners or key suppliers can have significant impact on the ESG impact score of retailers. Although these are not in direct control of retailers, they can impact brand image and the ESG score because of retailers’ association with such offenders. Global event databases like GDELT and graph analysis libraries like Graphframes help establish these complex associations. The importance of connections is derived based on an association analysis like how frequently retailers and associated partners (supplier, franchise) are mentioned together in news articles.

- Govt, social, NGO websites for localization: These websites are scraped to identify social issues of local interest and changes in regulations. This helps to identify key drivers for impactful ESG at the regional level. There are various AI and GenAI-based web-scaping tools in the market to support this. Blockchain solutions or data clean rooms can make this data exchange trustworthy and transparent.

Also, the blockchain technology is used to support goals like healthy food for all, responsible sourcing of products, trust in provenance and ingredients, and avoidance of counterfeited products. The technology offers traceability of all touchpoints of a complex supply chain to store product details in immutable format. Different cloud providers are providing blockchain as a service to provide emergency-efficient alternatives to build such solutions.

The way forward

The importance of establishing a data-driven ESG Impact measurement framework is a need of the hour.

The importance of a data-driven framework to promote sustainable sourcing, fair labor practice, and transparent supply chain is well understood by retailers and their investors. These practices are also attracting modern consumers who are more environmentally or socially conscious, and they also improve the overall brand image and customer loyalty in the long run. Unfortunately, the current data-driven ESG initiatives are accessible to only large retailers and suppliers with significant IT investment and skill. A focused attempt should be made to extend this to medium and small retailers across the globe by building a data consortium and common data service that is accessible to all. This will help bring in transparency to all ESG investments that retailers make and will extend the reach to all communities across the globe.