Industry

Solution

HIGHLIGHTS

- Quick commerce has revolutionized the retail landscape by meeting the modern consumer’s demand for rapid delivery, often within 30 minutes.

- Analyzing the operating models of leading retailers, we observed diverse strategies in managing ordering channels, fulfilment, and last-mile delivery, highlighting the balance between owned and outsourced capabilities to optimize efficiency and service quality.

- To achieve profitability in quick commerce, retailers must adopt a three-phased approach to capture all the revenue levers of indirect sales, direct sales, and other income streams.

On this page

The rise of instant convenience

In the era of quick commerce, a subcategory of e-commerce, convenience meets speed in the realm of retail innovation.

As technology continues to reshape our daily lives, the landscape of shopping experiences is undergoing a dramatic transformation. From groceries to gadgets, the ability to have products delivered to the doorstep within a few minutes is no longer a distant dream, but a recent reality.

In this new age of instant gratification, market trends indicate an accelerated adoption of quick commerce worldwide. With the current global user penetration of just over 7%, the quick commerce space is already crowded with multiple digital native startups, leading brick-and-mortar retailers, and vertically integrated players. With the quick commerce industry expected to reach a potential market value of over US$ 250 billion by 2029 at a steady CAGR of over 9%, investors are pouring funds into innovative startups. Retailers have started investing heavily in logistics and infrastructure to meet this surge in on-demand orders, leading to fierce competition and innovative solutions like dark stores and autonomous deliveries.

However, balancing high operational costs with revenue has become a huge hurdle for competing in this space, which raises questions about the profitability of the quick commerce model. We delve deeply into the fundamentals of the quick commerce phenomenon and provide our views on how brick-and-mortar retailers can build a profitable presence in this low-margin yet highly competitive landscape.

The quick commerce operating model

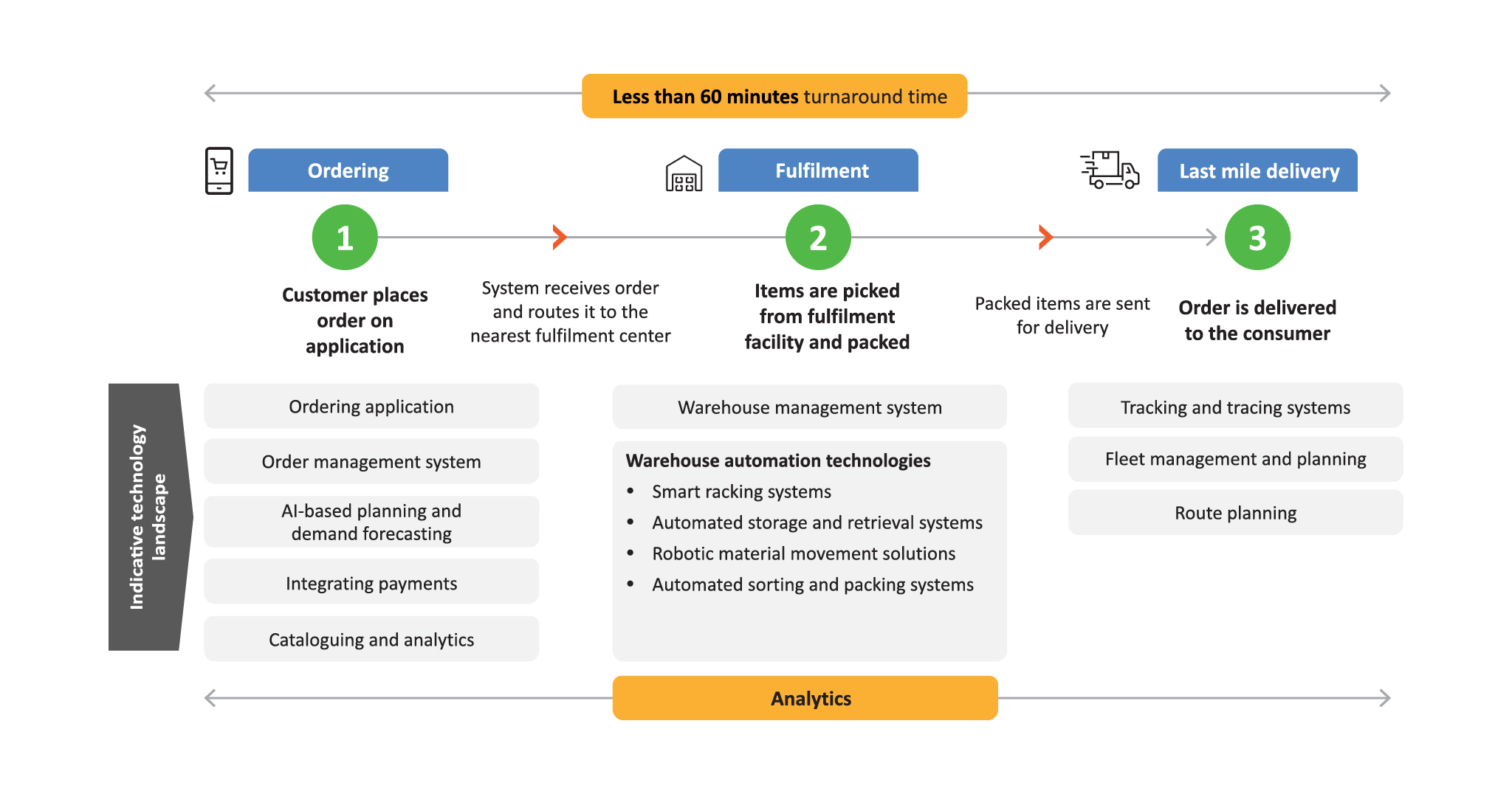

Quick commerce operates on a streamlined model comprising three key components: ordering, fulfilment, and last mile delivery.

Customers initiate orders through intuitive platforms or apps, selecting the desired items from a highly curated assortment range. Fulfilment involves efficient picking, packing, and processing of orders, often within dedicated facilities, or dark stores, optimized for speed. Last mile delivery ensures swift transportation from these hubs directly to customers’ doorsteps, often leveraging advanced logistics networks or gig economy workers (see Figure 1).

Each of the components shown in Figure 1 can be managed in either of the following ways:

- Owned entirely by the retailer

- Outsourced entirely to a third party or an ecosystem player

- A hybrid approach

By identifying the right levers to operate between this own-to-outsource spectrum, and harmonizing the three operating model components, quick commerce businesses can achieve economies of scale, drive down per-unit costs, and ultimately bolster their overall unit economics for sustained profitability.

We studied the quick commerce strategies of more than 15 leading brick-and-mortar retailers in advanced and emerging economies. We identified dominant trends across operating models and have showcased some of our key findings in the following sections.

Hybrid ordering for reach

Retailers are aiming to maximize their channel presence.

Whether it is a dedicated direct channel for quick commerce or collaborating with leading instant delivery players, retailers are keen to be present on multiple ordering channels to offer accessibility and availability to end customers.

In the direct channel route, most retailers have rolled out a dedicated application exclusively for their on-demand offerings with features such as end-to-end order tracking, subscription and loyalty services, delivery support, artificial intelligence (AI) recommendations, and so on. With a dedicated quick commerce application, a leading retailer in Australia also integrated on-demand and slotted-demand quick commerce offerings in its existing e-commerce applications to leverage the existing user base. A few leading retailers in South Africa, Australia, and France have also acquired struggling third-party quick commerce start-ups to increase their direct channel portfolio.

In the indirect channel route, partnering with established instant delivery players in the region has been the single most dominant trend across geographies. A leading South African retailer also entered a joint venture with its last-mile logistics partner to scale up its on-demand technology platform and cater to its customers’ growing quick commerce needs. A household grocery retailer in the UK partnered with a regional grocery delivery provider to white label its online ordering application and use its network of personal shoppers in select regions.

Owned fulfilment for speed

Automated and distributed micro networks are crucial for efficient order fulfillment.

The X factor in quick commerce lies in its blend of innovative fulfilment approaches and efficient logistics. Leading quick commerce providers have capitalized on technological innovation to reshape fulfilment trends, thereby reducing the pick, pack, and sort times at fulfilment centers to barely a few minutes.

All the retailers that we studied are using their distributed physical store networks and are automating a section of their stores to enable in-store fulfilment capabilities. Most retailers across geographies are also investing heavily in building a distributed network of completely automated micro- or nano-fulfilment centers, known as dark stores, that are accessible to major population clusters. These micro-fulfilment centers act as delivery-only centers to exclusively cater to steadily increasing online orders. Some retailers in the UK are also experimenting with the dark-store format by enabling omnichannel capabilities such as buy online, pick up in-store (BOPIS) and digital kiosk ordering at stores to increase revenue per square foot of dark stores.

As an exception, a leading Australian retailer is making big bets on the centralized fulfilment model by using state-of-the-art large and automated distribution centers and customer fulfilment centers. While this interesting approach seems synergetic to its other e-commerce offerings, industry experts are curious to witness the retailer’s ability to compete in this time-intensive quick commerce market.

Outsource logistics to optimize costs

Retailers are increasingly outsourcing their last mile logistics to instant delivery providers to harness their expertise and expansive networks.

This strategic move allows them to meet the burgeoning consumer demand for rapid deliveries by focusing on their core competencies such as rapid fulfilment and inventory management, while leveraging the prowess of delivery specialists. With large fleets of two wheelers powered by the gig network, instant delivery providers use superior logistics algorithms. They have optimized their operations to handle the complexities of urban deliveries, ensuring high speed and efficiency. Partnering with delivery providers also enables retailers to scale rapidly without making heavy investments in building an in-house fleet.

A considerable segment of retailers is also focusing on building an electric and autonomous vehicle fleet to prepare for the future of quick commerce while meeting sustainability goals. To fuel its quick commerce proposition, a leading Australian retailer has partnered with a drone delivery specialist and has started delivering over 250 stock keeping units (SKUs) to select regions using autonomous drones. This is an early hint of a futuristic transformation of logistics in the quick commerce landscape.

The path to profitability

The future of quick commerce for retailers will depend on how they manage the intricate profitability and unit economics challenges.

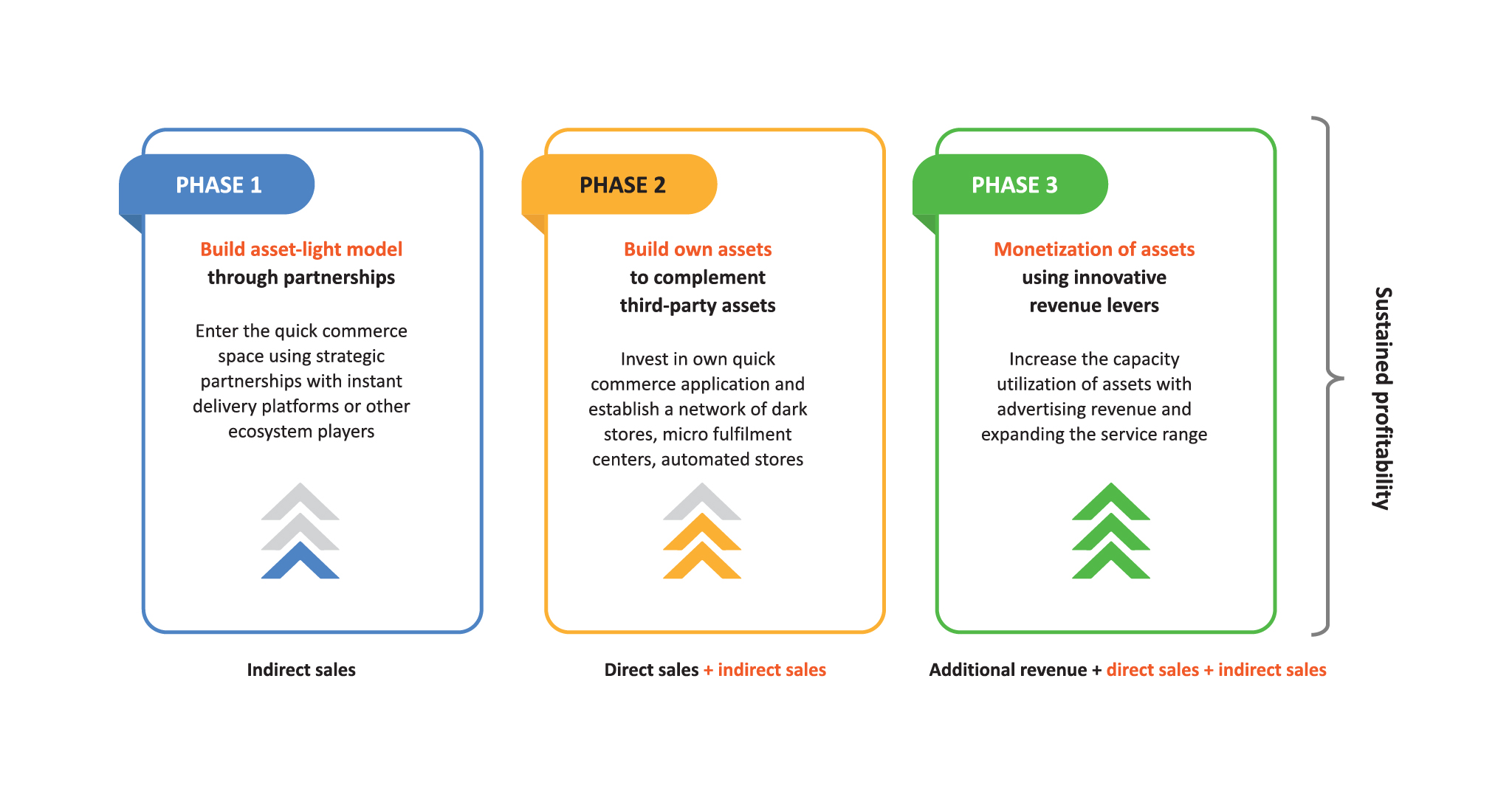

Achieving the right balance of speed, service quality, and cost efficiency necessitates a strategic, phased approach (see Figure 2).

In phase one, retailers should prioritize building an asset light model through strategic partnerships with third-party providers and instant delivery platforms. This approach minimizes initial capital expenditure and leverages the existing infrastructure and expertise of partners, ensuring rapid scalability and operational efficiency. Retailers can focus on core areas such as customer engagement, assortment curation, and enabling in-store fulfilment. They can rely on partners for listing on their ordering channels, pick-and-pack services, and fulfilling deliveries in a radius of less than five kilometers. This will enable retailers to compete in the 30- to 60-minute delivery space.

As the business matures, phase two will involve building proprietary assets to complement third-party resources. This hybrid model combines the flexibility of outsourced services with the control and customization of owned assets, allowing retailers to refine their service offerings and improve margins. Investing or co-investing in automated micro-fulfilment and in-store networks has the potential to allow retailers to deliver five times the volume of a normal store. We have observed that a few retailers with these capabilities are able to pick and pack orders in as less as four minutes. To increase service reliability, retailers can also consider investing in a selective in-house delivery fleet and should aim to deliver orders within the radius of less than three kilometers. This will enable them to bring down the delivery time and compete in the 15- to 20-minute delivery space.

Finally, in phase three, retailers should focus on monetizing assets using innovative revenue levers. Some mature retailers in our study have diversified revenue streams by launching premium subscription models, expanding from on-demand grocery to on-demand meal delivery services. They have built in-house gig networks to facilitate delivery as a service (DaaS) to other players and have entered brand collaborations to fully utilize lucrative advertising opportunities within retail media.

This phased approach will not only guide retailers toward a sustainable and profitable quick commerce model but will also ensure adaptability and resilience in a competitive market. By judiciously combing partnerships, proprietary assets, and innovative monetization strategies, retailers can effectively lead the future of quick commerce.