What we do

Highlights

- Money laundering using cryptocurrencies is a growing concern. An anti-money laundering mechanism, therefore, is being proposed to detect accounts involved in illicit financial transactions.

- The mechanism involves building a generalized synthetic data generator that would help embed dynamic behavioral patterns of crypto entities from publicly available transactions into a customizable synthetic transactional dataset.

- The information represented through a synthetic transactional dataset would then be computed to measurable attributes through feature engineering to train an AI-powered anti-money laundering (AML) model.

- This trained AML model will identify discrepancies in the transactional behavior of real accounts and classify such accounts as either illicit or licit.

- Businesses involved in crypto or financial activities can use this AI-powered mechanism to detect money laundering accounts from their transactions.

On this page

Detecting illicit crypto transactions is critical. Here’s why and how

Money laundering through cryptocurrencies can impact financial and economic growth.

The cryptocurrency market has witnessed an exponential growth over the past few years, recording a market capitalization of crypto assets worth over $2.79 trillion in March 2024, as per International Monetary Fund’s Global Financial Stability Report, April 2024. This has fueled the development of several crypto-linked applications and services. Cryptocurrencies are now widely accepted because of their inherent privacy features, ease of cross-border transactions, decentralized model, transparent and verifiable transactions, and distributed and immutable records.

Ironically, some of its unique selling points or USPs, including the inbuilt privacy features, also make the crypto ecosystem vulnerable to money laundering and other illicit financial activities.

For instance, lack of stringent global regulations, pseudo-anonymous (trackable but with masked identity) accounts, multiple unregulated entry/exit points in the ecosystem, presence of multiple parties in a single transaction, and availability of third-party services for obfuscation make it easier for cyber criminals to exploit the system. As a result, cryptocurrencies are increasingly being used for illicit activities, such as ransomware payments, illicit trading, terror financing, scams, money laundering, and others.

Most illegal activities lead to money laundering as it helps integrate illicit and obfuscated funds back into the legitimate financial ecosystem. A strong money laundering detection system is, therefore, critical as many businesses, banks, and financial institutions dealing in crypto can be affected.

To tackle these challenges, this paper proposes a mechanism to generate a generalized synthetic dataset of cryptocurrency transactions representing a customizable end-to-end money laundering scenario in a crypto ecosystem in which multiple entities are engaged. The dataset would then be used to train an AI model to detect discrepancies in financial activities.

Existing approaches to detect illicit activities remain inadequate

The increasing scale of transactions demands a shift from native to modern techniques to identify deep patterns. The existing methods are inadequate to deal with the current challenges, hence the need for a new mechanism.

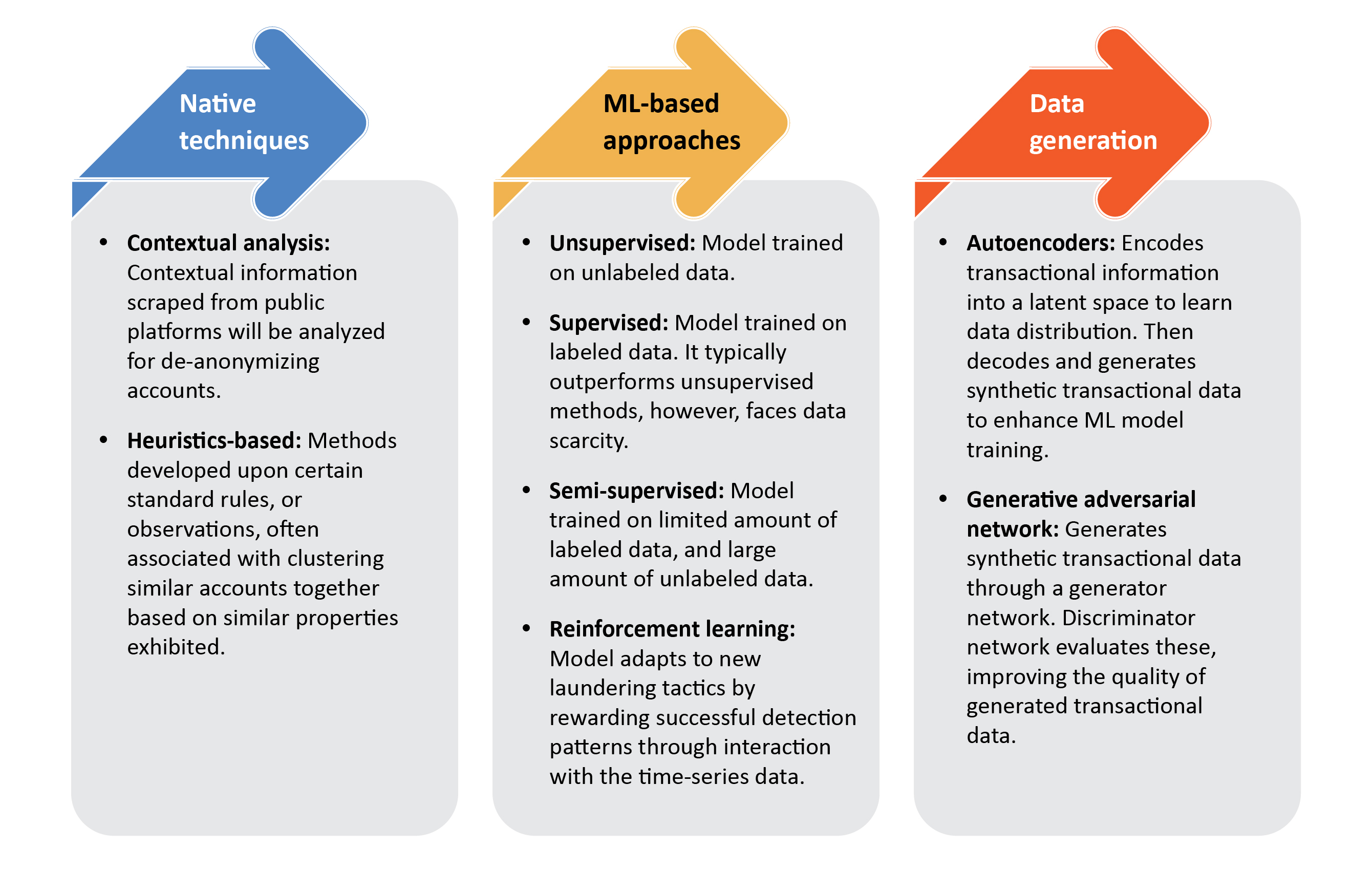

With transactions growing multi-fold in the crypto-market, native techniques based on heuristics and contextual analysis cannot be solely relied upon to accurately identify money laundering activities. These approaches find it challenging to analyze large volumes, and detect deep underlying patterns within the transactions, calling for a shift to (semi-)automated techniques using machine learning (ML), deep graph analysis, and data mining.

While a semi-supervised learning approach fits the case to an extent by requiring only limited labeled data, the latter, however, often does not fully cover the intricacies of real-world scenarios and laundering patterns. As money laundering encompasses numerous entities and transactions, it becomes imperative to have diversity in a dataset when training a model. Missing out even a single pattern can make the system vulnerable. Thus, a dataset lacking diversity may give the consumers false biases, causing reputational and monetary impact on businesses.

Data generation, therefore, becomes essential to embed diversity in transaction patterns. Even the most used data generation techniques, such as variational autoencoders and generative adversarial networks or GAN, need training samples to fully represent the data required to generate the corresponding transactional patterns.

Crypto transactions being pseudo-anonymous (trackable but with masked identity), make it difficult to recognize the type of pattern a particular transaction is following, or an address that belongs to an entity as part of the transaction, or the nature of a transaction. Hence, providing labeled or informed transactions for generation becomes unfeasible.

Therefore, a dynamic simulation model generating synthetic data becomes vital to embed behavioral patterns related to multiple entities and transactions.

Simulating a cryptocurrency transaction ecosystem

The proposed mechanism will provide adequate behavioral patterns of various entities to train an AI model to detect money laundering activities.

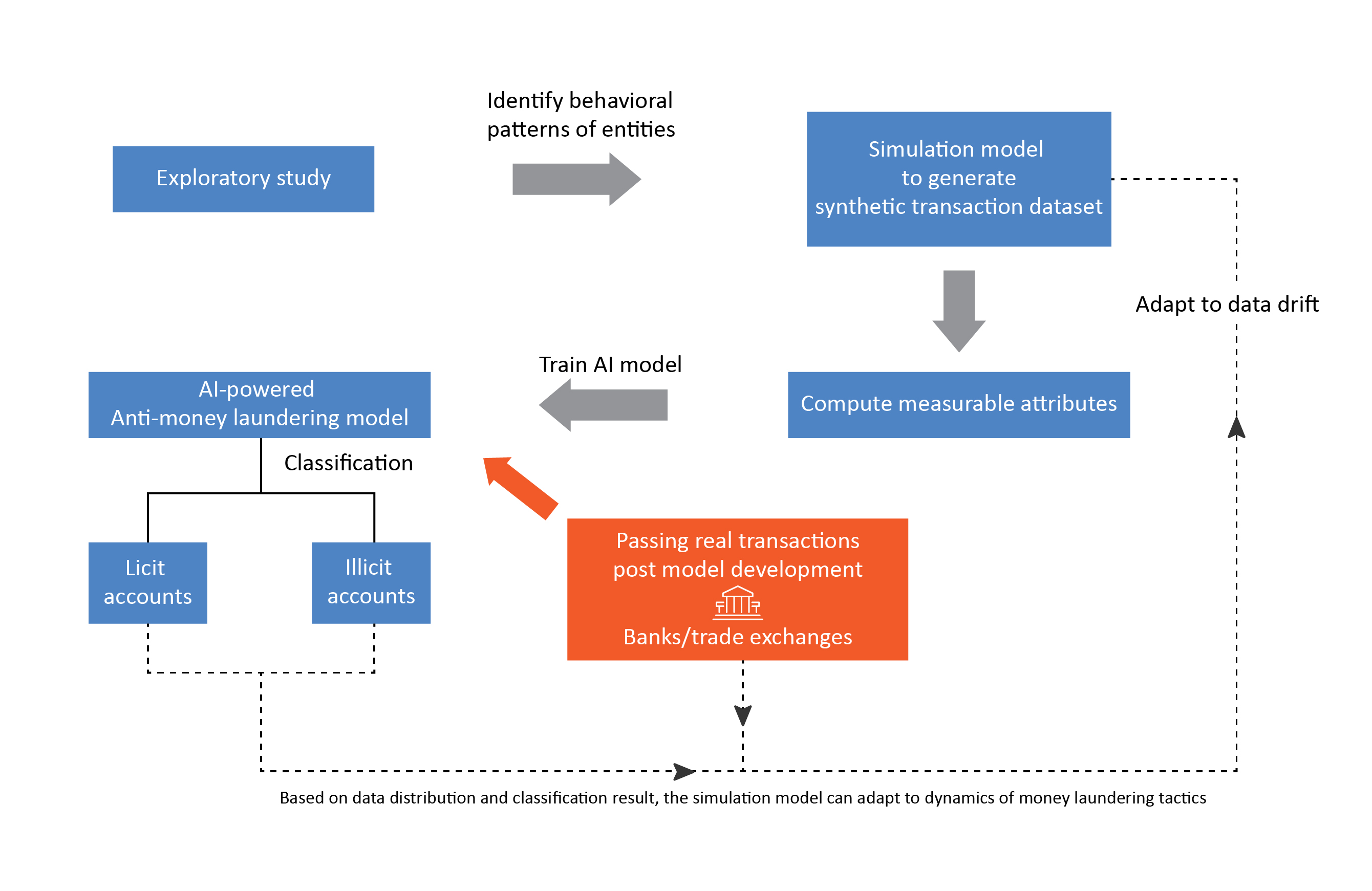

Money laundering involves illicit fund inflows from all sorts of crimes. A diverse dataset based on exhaustive and exploratory study, therefore, becomes essential to trace such monetary flows, identify behavioral patterns from transactions, generate scenarios, and train models to detect money laundering activities. The literature for the exploratory study could include publicly available transaction information of flagged and labeled accounts, crime reports, and case studies; press releases from government, intergovernmental organizations, and law enforcement agencies—marking regulatory red flags.

The exploratory study must capture behavioral patterns of entities—such as crypto exchanges, mixing services, nested services, escrow services, money mules, etc., along with varied tactics that the launderers use to obfuscate funds. The outcome of this study becomes the basis or the domain knowledge to build a simulation model. The simulator will generate a synthetic dataset, mimicking different behavioral patterns and transaction types, to represent an end-to-end money laundering scenario in a crypto ecosystem in which the entities are engaged.

The behavioral patterns represented from the generalized synthetic transactional dataset for accounts and its associates must then be translated into measurable attributes through feature engineering—a process that helps improve the performance of a machine learning model.

The computed attributes are then used to train an AI-powered anti-money laundering (AML) model. The AML model can predict and classify whether an account is involved in money laundering activity or not. Institutions such as banks and trade exchanges can use this AML model to vet real transactions and identify licit and illicit accounts. Furthermore, it alerts the users and authorities, thereby safeguarding funds and institutional reputation.

Based on the classification report of real transactions, the simulation model will adjust its generating modules, if required, to adapt to the changing tactics of launderers and the behavior of entities, facilitating a dynamic solution for business continuity.

Get future-ready

A strong anti-money laundering detection mechanism will empower institutions to prevent financial crimes and illicit activities more effectively.

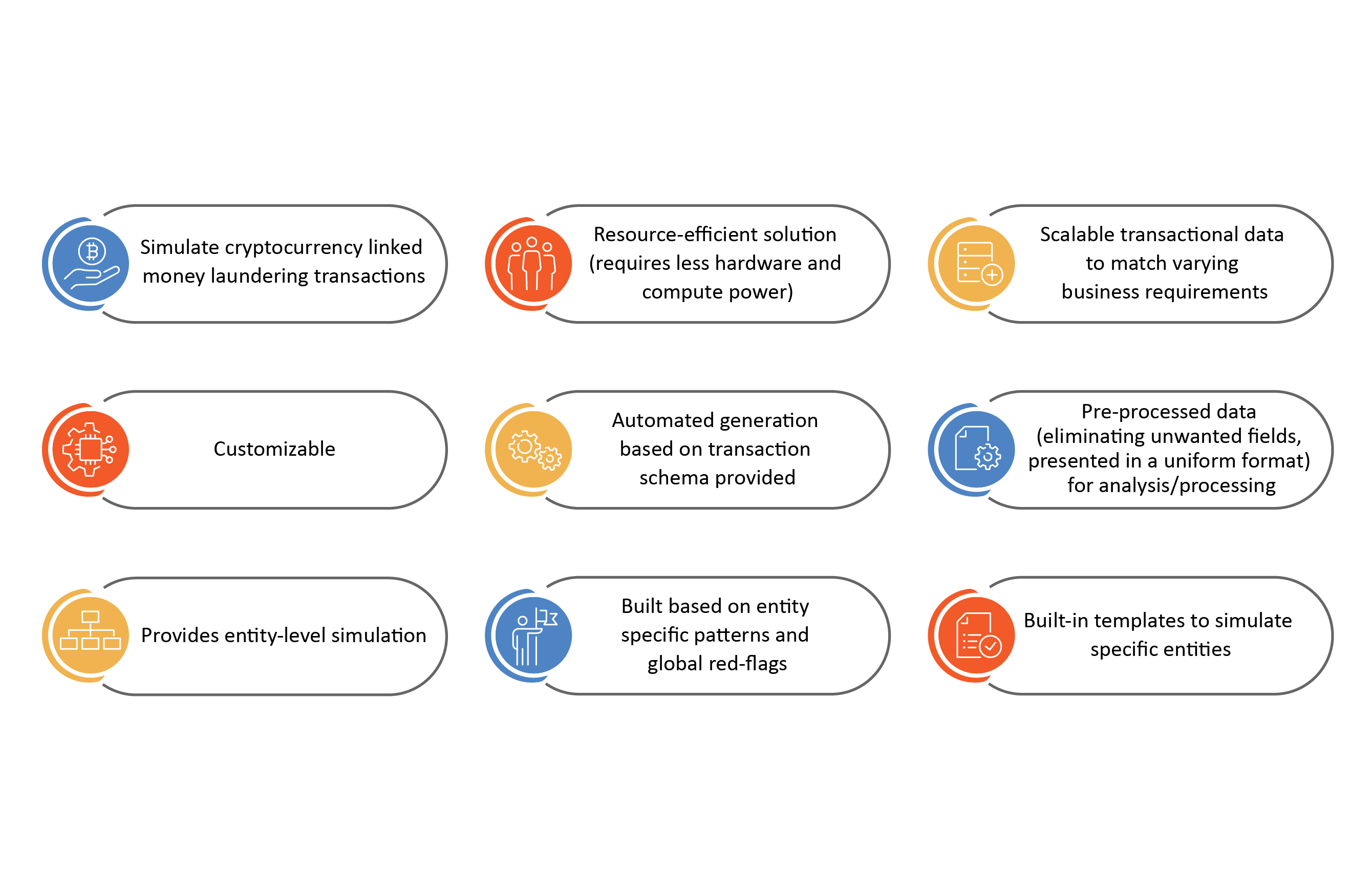

The money laundering detection mechanism described in this paper will help generate behavioral characteristics of various entities involved in financial and crypto transactions to effectively train models in a dynamic way. It will provide institutions and businesses with a platform to track and analyze real-world transactions for any criminal activities.

Such a mechanism must be scalable and facilitate customization for enterprises to integrate existing processes and third-party plugins. At the same time, it must be robust, making it difficult for malicious users to make any alterations.

With technology rapidly evolving and financial crimes rising, the fight against crypto money laundering requires a collaborative effort between regulators, institutions, and the crypto community. Businesses, especially those involved in FinTech, need a strong, resilient, and secure system with a comprehensive detection framework that can tackle emerging challenges while complying with evolving rules and regulations.