Solution

Highlights

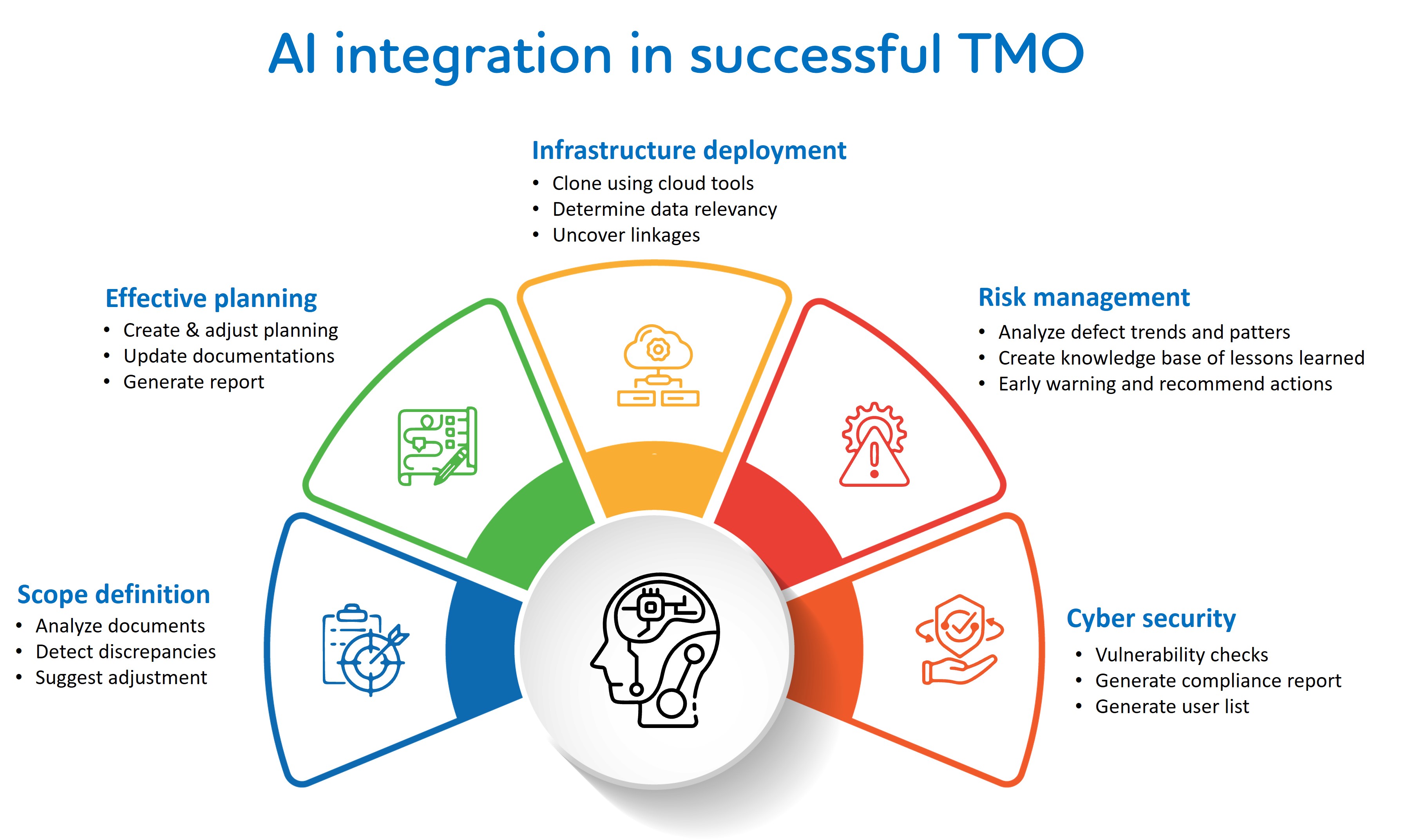

- Integrating AI into the transaction management office can streamline documentation updates, enhance data relevancy, and improve risk management.

- AI-driven tools automate report generation, determine data linkages, and manage cybersecurity vulnerabilities effectively.

- Leveraging AI can improve scope confirmation, infrastructure deployment, and the overall efficiency of the merger, acquisition, and divestiture (MA&D) process.

On this page

Scope definition

Clearly defining the scope with AI-driven insights

In mergers, acquisitions, and divestitures (MA&D), the Transaction Management Office (TMO) plays a critical role in overseeing and executing complex processes. While traditional TMOs focus on project management fundamentals, incorporating AI can enhance the efficiency and success of these activities.

Defining the scope of a transaction is crucial, as it involves establishing clear boundaries and objectives for both the seller and the buyer. This includes defining what is being acquired or divested, ensuring buyers receive only the data they are entitled to, even from the customer list and vendor data.

AI can enhance scope definition by automating the reconciliation of scope changes, impacts, and cost estimation for change requests (CRs). AI tools can rapidly analyze scope documents, detect discrepancies, and suggest necessary adjustments, such that aspects of the transaction are accurately captured. This reduces the risk of scope creep and helps maintain project timelines. Additionally, user list generation and segregation of duties (SOD) verifications can also be automated, reducing the burden on human resources.

AI’s integration in key aspects will ensure the success of a TMO (see Figure 1).

Effective planning

Creating an achievable plan that includes the clear definition of different workstreams, dependencies, integration points, and tracking mechanisms is critical for successful execution.

This may sometime require negotiation between the deal team and IT to deliver on commitments pertaining to both the deal scope and timelines. Scope alignment, ie, what can be delivered in the time allowed, is also key.

Capabilities that cannot be delivered within the time allowed should be moved down the priority list and the possibility of delivering an abbreviated capacity via transaction service agreement (TSA) should be evaluated. This plan should be detailed, comprehensively covering aspects of the MA&D process to assist in smooth execution.

Clearly defining the workstreams and their respective roles and responsibilities can avoid confusion and delineate each party’s accountability. AI can automate the process of updating documentation, such as data models, application portfolios, and system schematics. This allows stakeholders to have access to the latest information, reducing the likelihood of errors.

AI-driven tools can also generate accurate and comprehensive reports by pulling data from various sources, improving data accuracy and completeness. These reports can include detailed data set lists and infrastructure deployment status, providing a clear overview of the project’s progress.

In mergers, acquisitions, and divestitures (MA&D), the Transaction Management Office (TMO) plays a critical role in overseeing and executing complex processes. While traditional TMOs focus on project management fundamentals, incorporating AI can enhance the efficiency and success of these activities

Infra deployment

AI can streamline the infrastructure deployment process by automating the cloning of environments using cloud tools, ensuring that infrastructure is deployed quickly and consistently.

In a business divestiture scenario, the existing IT landscape can serve as the reference and a cloud-based landscape can be provisioned to match existing capabilities. Meanwhile, determining the relevancy of data in MA&D transactions is crucial for making informed decisions. The decision points can include delineation of business product line information, cost and pricing data, engineering designs, or key customer and vendor relationships. AI can quickly identify where specific data elements exist throughout a data model, helping to uncover linkages and relationships that might otherwise be missed. This is particularly useful in complex system landscapes, where understanding the dependencies of data stored in multiple systems is key to a successful integration.

Risk management

Creating an AI-driven knowledge base can improve risk management.

Throughout the MA&D transaction-enablement process, various issues and defects are logged. AI can analyze this data to identify patterns and trends, creating a searchable knowledge base of lessons learned. These learned issues and their resolutions can serve as a reference model to be compared against current program attributes to provide early warning and recommended actions for similar situations. This continuously evolving resource can be invaluable for current and future transactions, helping teams to avoid previously encountered scenarios and implement proven solutions.

AI can play a role in risk management by monitoring project data and proactively identifying potential risks before they escalate. This includes evaluating the impact of scope changes, tracking project plan updates, and estimating the likelihood of various risks materializing.

AI could also calculate schedule performance index (SPIs) and directly evaluate project completion status by automatically retrieving work completion data against the total defined scope for each task. The next level could be identifying the significant SPI variances and making recommendations for course correction. This real-time analysis helps teams stay on track, make informed decisions, and anticipate risks to address them at the earliest stage.

Cybersecurity

AI can provide value in the critical area of cybersecurity

AI can perform cybersecurity vulnerability checks across the new system landscape, confirming that the systems involved in the MA&D transaction are secure from outside penetration and generate compliance reports to present the results. This benefit can apply to both buyers and sellers who wish to verify that access to corporate systems is only available to those for whom it is intended and can create a documented audit trail of the testing performed, findings, and remediations.

AI can also be used to generate user lists, separating corporate groups by their future company alignment, and then provisioning them to the correct StayCo/SpinCo systems. This application provisioning process could also assist in the verification of functional business controls, thereby significantly reducing efforts for these time-consuming tasks.

Improve efficiency, effectiveness of MA&D activities

Integrating AI into the transaction management office can bring a new level of efficiency and effectiveness to MA&D activities.

From scope definition and documentation updates to risk management and cybersecurity, AI enables TMOs to handle the complexities of MA&D with greater efficiency and confidence.

While AI cannot guarantee a flawless process, it significantly enhances the probability of a successful transaction by providing accelerators and insights that are difficult to obtain in traditional approaches.

As companies continue to explore AI’s potential, those that embrace these technologies will be better positioned to navigate the challenges of MA&D and achieve their strategic objectives.