INDUSTRY

Highlights

- To be future-ready, it is vital that enterprises integrate environmental, social, and governance (ESG) initiatives into their ecosystems.

- Governments around the world are gradually revising ESG compliance and regulations to improve transparency.

- To secure green finance from investors, organizations must meet regulatory standards and finalize their sustainability roadmap.

On this page

The future is now

Though cautiously undertaken, incorporating and embedding sustainability principles into the organizational culture has become a top priority for firms.

Integrating environmental, social, and governance (ESG) initiatives into an enterprise's ecosystem can be tricky. On one side, there is fear of rising interest rates and economic slowdowns, and on the other, there are government-funded opportunities promoting sustainability initiatives.

Globally, governments are gradually revising compliance and regulations to improve transparency, while businesses seek to bridge the gap between arranging and managing funds for sustainability and ESG initiatives. Historically, the primary driving force behind capital allocation has been financial value, return on investment, and maximizing shareholder wealth. Recently, the emphasis has shifted to evaluating enterprise value, including non-financial value and contribution, initiatives, and strategy for sustainability development goals (SDG).

Although sustainability-related regulations are becoming increasingly complex, they also offer growth opportunities. Enterprises must focus on:

- Strategies for sustainable financing

- Capital allocation

- Business expansion and diversification while managing sustainability targets

- Building investor trust

A sustainable strategy

The size of an enterprise, project-specific requirements, market conditions, and other variables impact its financing structure.

Investors need to align their portfolios to include widely acknowledged sustainability objectives, making ESG-aligned projects more appealing for funding. Financing options for sustainability incentives require:

Investor commitment: Philanthropic investors voluntarily support ESG adoption and preservation. To enable trust, such investors need more transparent and high-quality sustainability reporting. International financial reporting standards (IFRS) S1 and S2 create a common framework to address investor concerns and clearly define the scope, purpose, and accountability. There will be a need for high-quality and reliable data. Technology has a critical role to play in data management.

Green finance debt structure: Various finance debt supports sustainability initiatives. These bonds cover enormous scope and promote initiatives impacting sustainability in the long term. Enterprises should be aware of the green debt instruments available to fund sustainable project and under what category their project qualifies. The following are the most popular bonds and debt instruments available to enterprises:

- Green bonds support initiatives that are aimed at the European Union (EU) taxonomy-compliant activities and positive environmental change. They are less risky and issued to motivate and support projects aiming to achieve net zero goals.

- Green loans exist in private markets and are designed to encourage companies to adopt sustainable project engagements and, in return, enjoy financial benefits. Commercial lenders or peer-to-peer lending are the primary sources of green loans.

- Sustainability-linked bonds (SLBs) are behaviour-based bonds that depend on the requestor meeting sustainability objectives by a specific date. If the project meets environmental, social and governance (ESG) requirements set by the investor, it becomes eligible for this bond. The investors in such cases are primarily banks and if the enterprise cannot meet the targets, it must pay more interest.

- Sustainability-linked loans (SLLs) use incentives to encourage enterprises to achieve sustainability goals, such as positively varying interest rates influenced by sustainability performance. If sustainability goals are upheld and interest rates are kept low, the enterprise's capital will expand rapidly and give investors a consistent cash flow stream. SLLs operate within the private sector.

- Sustainability bonds are financial instruments that must adhere to the international capital market association (ICMA) sustainability bond guidelines and are used to finance assets and projects and are issued to businesses, governments, and municipalities.

- Social bonds target social upliftment and are availed and further refinanced based on the outcome achieved, such as affordable housing, LGBTQ+ rights, and education equity. These activities and initiatives must align with the social bond principle (SBP) guidelines.

Government funding: Regulatory bodies and governments worldwide promote sustainability through incentives and tax exemptions. Various tax credits and government investments encourage initiatives to substantially reduce emissions from electricity production and consumption, transportation, industrial manufacturing, facility management and agriculture. Aligning corporate strategy with these initiatives could help meet funding requirements.

Partner funding: Large corporations, committed to 100% ESG compliant within their ecosystem, promote and help partners transition to and adopt sustainability goals by setting aside funds with clearly defined scope, process, and expected output to help meeting sustainability targets of their business partners, vendors, and suppliers.

Securing finance

Securing green finance requires organizations to meet various regulatory standards and be transparent with their sustainability roadmap.

An enterprise’s planning, reporting, and ability to build trust influences investors at every stage of green financing.

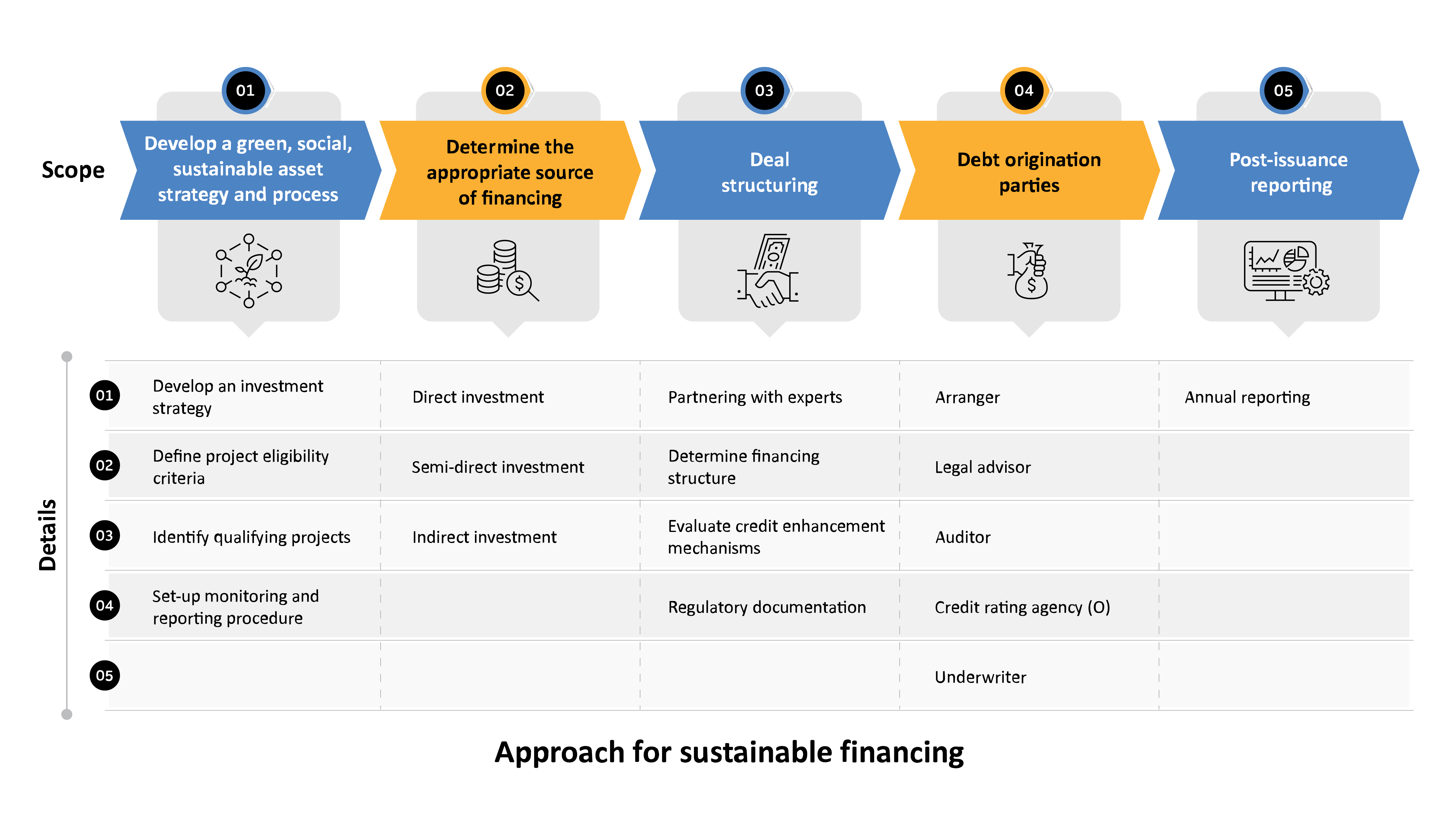

There's a five-step approach (see Figure 1) to securing green financing for sustainability initiatives:

The first step is to categorize the project and identify interested investors for the task category. Define the scope of the project and set targets to be achieved along with timelines. This will highlight how a particular activity is a part of the enterprise’s net zero journey.

Companies need to:

- Develop business case objectives: Ensure that the project objectives align with the targeted investors' eligibility criteria, as different investors are interested in various ESG goals.

- Create a framework: Develop the framework with a clearly defined scope, process, and targeted output for the projects. Listing down all the requirements are crucial to meet environmental, social, and economic standards as expected by the fund.

- Ensure transparent management: Deploy a team of professional consultants with clear roles and responsibilities to manage and track the funding from investors and approvals from legal advisory, auditors, credit rating agencies, and underwriters.

Investors seek projects that best fit their environmental aims. There’s a need to create a connection between companies that require funding and relevant investors. Absence of a transparent process to measure, collect, deliver, and communicate the progress of sustainability targets and achievements as per their sustainability roadmap, can pose a challenge for enterprises. Low investor confidence and the pressure of showcasing a positive return on investment in the short term while focusing on long-term sustainability investment requirements, can prove to be deterrents in finding relevant investor funding.

Sustainability watchdogs, industry analysts, and NGOs review an enterprise’s performance on sustainability along with its financial performance. These reports influence investor decision-making, leading companies to include them in their core agenda while meeting analysts. It is essential to include details on sustainability requirements with investment details planned, tracked, and reported. For this, enterprises must develop a risk mitigation strategy that considers pressing sustainability issues and their associated impact.

Adopting technology

To gain investor trust, enterprises must streamline reporting and data representation.

Areas where technology plays an essential role in becoming sustainable are:

Data management: For effective ESG governance, an enterprise must standardize data and build adequate internal disclosure control and procedures to make traceability easy. The transparency should be such that the integrity of the data cannot be questioned, with safeguards against unauthorized access.

Skill and talent management: Artificial intelligence (AI) in ESG investing can help analyze extensive data, changing market conditions, as well as evolving sustainability compliance and regulations. This may simplify the complex processes through natural language processing (NLP) and generative artificial intelligence (GenAI). Enterprises can review their strategy and incorporate investor expectations through sentiment analysis algorithms. ESG and finance teams must work closely to achieve better compliance reporting.

Reporting: GenAI will reduce the effort required to create reports. By adapting to changing regulatory environments, a GenAI system can create reports for SMEs to review and process further.

Sustainability matters

Sustainability is no longer an option, but a requirement to become future proof.

Investors today are visibly inclined toward initiatives that are environmentally friendly and socially sustainable. Enterprises must keep that in mind before planning products and projects.

By streamlining reporting structures, standardizing data definitions, and clarifying on the scope of sustainability parameters, enterprises can get the funding they require to move strategically toward their net zero goals, all while ensuring transparency throughout.