Industry

Highlights

- As the retail sector evolves, the traditional understanding of shrinkage is undergoing a transformation, demanding a modern approach to tackle its complexities.

- Retailers must consider all types of losses across the full spectrum of their organization.

- Our blueprint for shrinkage management offers a solid foundation, unlocking significant business benefits for retailers.

On this page

Retail shrinkage: An expanding profit killer

In today’s dynamic retail landscape, shrinkage is a persistent challenge for retailers.

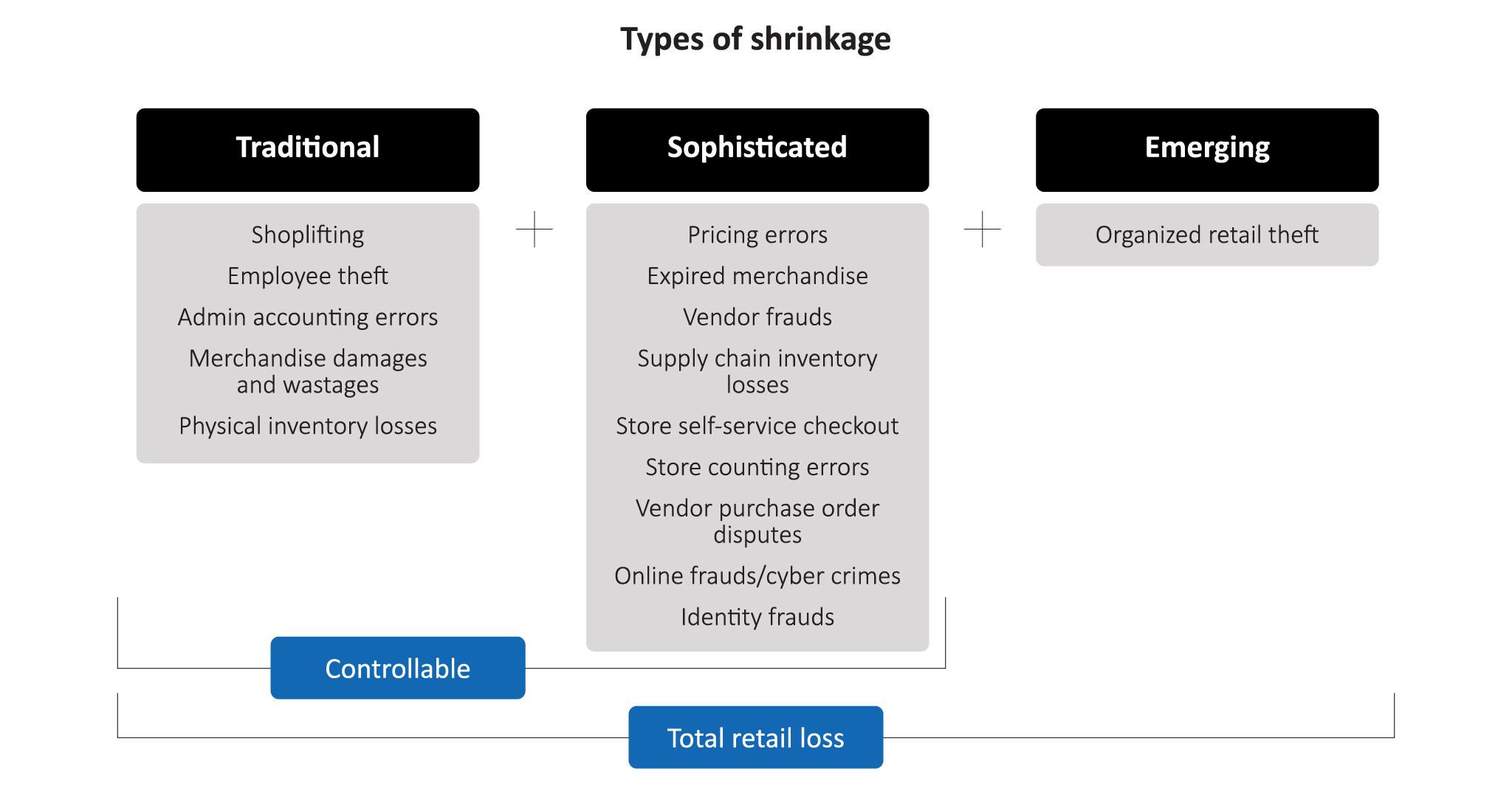

Retail shrinkage accounted for a significant US$112.1 billion loss, equal to 1.6% of total sales in FY 2022, up respectively from US$93.9 billion and 1.4% in FY 2021 (source: NRF 2023 National Retail Security Survey). Traditionally, it has been associated with physical store losses and supply chain discrepancies, but with the growth of online retail, new and sophisticated forms of shrinkage have emerged (see Figure 1). Particularly concerning is the rise of organized retail crime (ORC), which has infiltrated various segments of the retail industry over the past five years.

We delve into the complexities of this issue, explore its impact across the business ecosystem, and propose a diagnostics-based blueprint for tackling it effectively.

Fiscal impact of shrinkage across the business ecosystem

Retailers need to take a holistic approach to shrinkage considering all factors that contribute to retail losses.

A few by-products of shrink proliferation are the complexity and broad reach of the resulting fiscal losses across the retail business ecosystem. While most losses occur within the supply chain and store functional areas, the source and root cause of losses are rapidly extending into e-commerce. In fact, it is hard to argue that any retail corporate function is completely immune.

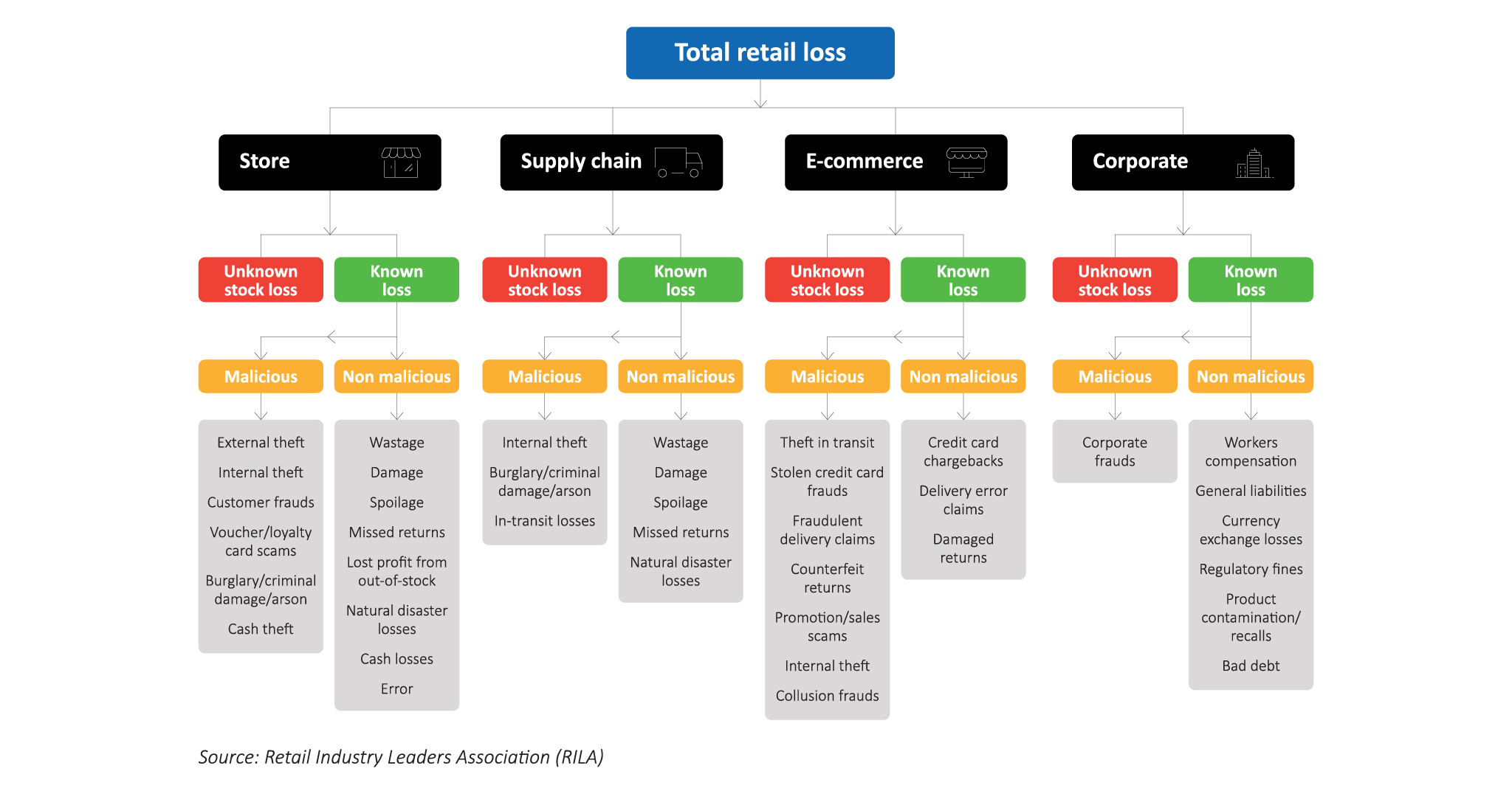

Complexity, reach, and other factors (inconsistent definition, measurement, categorization) have given rise to the concept of total retail loss (TRL) (source: Beyond Shrinkage: Introducing Total Retail Loss, Retail Industry Leaders Association), which is increasingly being adopted by retail industry leaders as a future-forward alternative to traditional retail shrinkage. According to the Total Retail Loss 2.0: From Theory To Practice report (source: Retail Industry Leaders Association), total retail loss differentiates retail losses from retail costs, then starts its typology by classifying losses into four functional categories: store, supply chain, e-commerce, and corporate (see Figure 2). Within each category, known stock losses are separated from unknown losses. Known losses are then defined and categorized as either malicious or non-malicious.

The typology clearly illustrates the broad exposure of total retail loss across the business ecosystem and the penetration level within each category. It also suggests how retail loss intersects with business processes, technology, and personnel. This perspective reinforces the value of bringing transparency to the complexity of total retail loss. It demonstrates the importance of having efficient business processes, integrated systems and data, and informative loss prevention programs. Additionally, it helps measure, manage, and minimize retail loss liabilities such as:

Inventory losses, impacting in-stock percentage and on-shelf availability

Inaccurate inventory counts, leading to erroneous merchandise ordering and overvalued or undervalued inventory

Lost sales at both cost and retail price

Negative gross margin impact

Vendor disputes, with associated costs and potential strain on relationships

Customer dissatisfaction, leading to reduced shopping trips and transaction sizes

Business market valuation loss, resulting in a decrease in shareholder value

The time for transformation is now

Retailers must embrace transparency in loss data and share corrective actions to effectively mitigate losses.

Historically, retailers have shared only high-level comparisons to industry averages and rolled shrink into cost of goods sold rather than report it as a discrete line item on financial statements. This position may be changing as an increasing number of well-known retailers have recently attributed below-expectation financial performance, in part, to significant increases in organized retail crime-related shrinkage.

When questioned about the details of incremental shrink claims, retailers have had difficulty producing specifics, citing challenges with timely and accurate shrink measurement. Experts speculate that some retailers could be using organized retail crime-related shrinkage to distract from the traditional challenges that drive retail shrinkage such as poor inventory management, inefficient processes, and employee theft—all controllable forms of shrink.

Given this scenario, it is fair to question why retailers continue to struggle with defining, measuring, and subsequently managing retail shrinkage. Is it not to a retailer’s benefit to reliably understand and transparently share loss data and planned corrective actions? There is no better way to prepare financial markets and support lobbying efforts to local, state, and federal governments. Sharing loss data will also help inform consumers about the potential need for store closures, preventive measures, limited assortments, increased prices, and other measures under consideration. The time for transformation is now.

Diagnostic assessment to rein in total retail loss

A diagnostic assessment of business processes, technologies, and people can help establish a transformation roadmap for shrink mitigation.

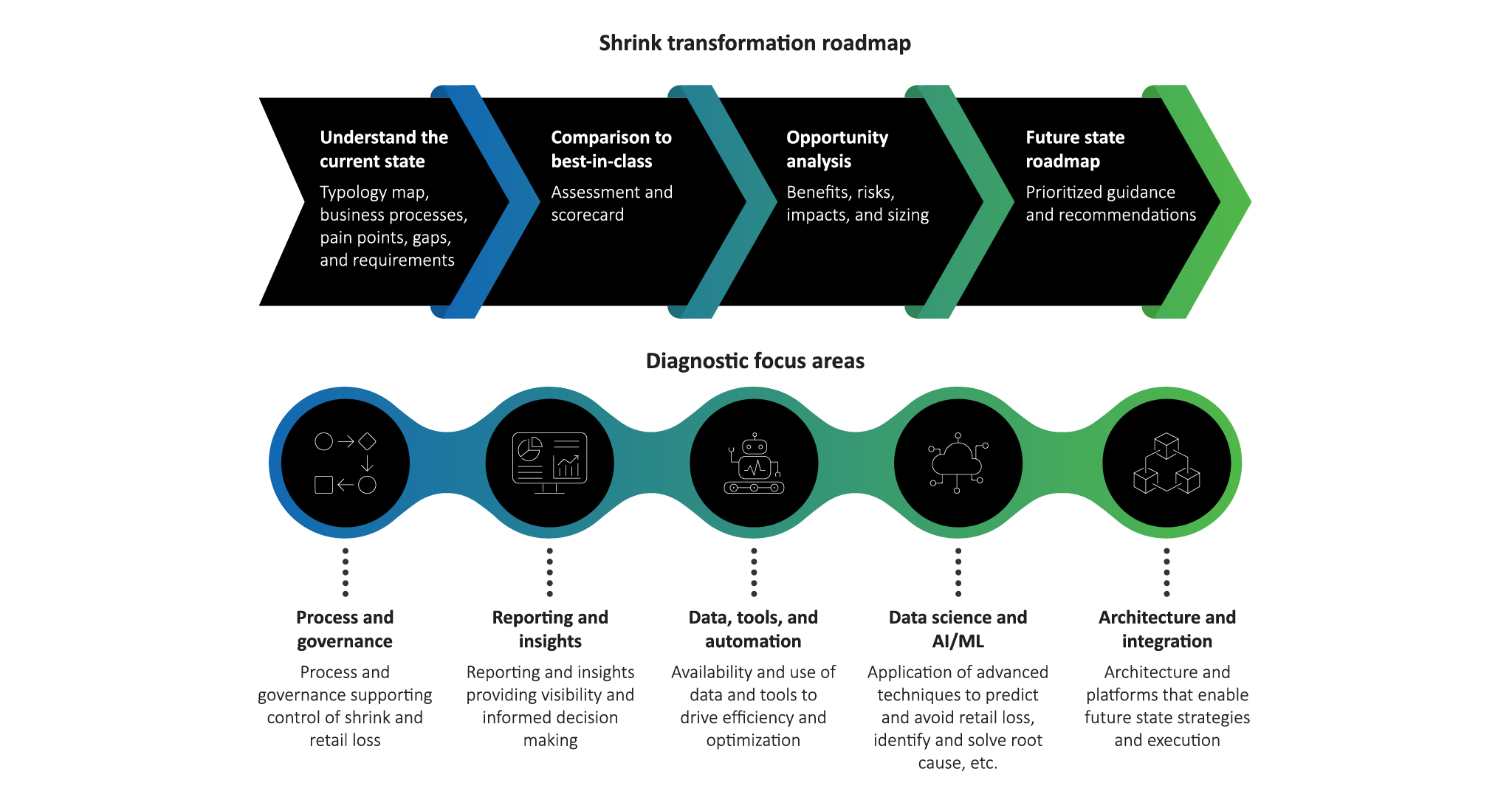

Total retail loss requires effective diagnosis and technology enablement to support measurement, control, and mitigation. Today, most retail organizations monitor shrinkage in the physical store and supply chain environments via traditional methods and organized retail crime through the store loss prevention department. This approach accounts for approximately 80% of total retail loss, leaving 15-20% unaccounted for. However, leveraging store loss prevention often provides only a narrow view of total retail loss, leaving the more sophisticated forms unaddressed.

Since most retail organizations have some level of shrink prescriptions and treatment plans, retailers must consider having a thorough total retail loss-based current state diagnosis as a prerequisite to transformation from traditional shrink. This diagnostics assessment (see Figure 3) will produce highly accurate and more reliable results than were previously available. Unlike traditional methods of monitoring retail shrinkage that provide only a narrow view, a holistic assessment will help identify total retail loss touchpoints in the ecosystem. This can then be used to establish a new, better-informed, and highly prioritized transformation roadmap for mitigation.

Process and governance: Processes form and bind the framework within which the total retail loss transformation will occur. Diagnosis components may include identifying loss nodes along the end-to-end product flow (forward and reverse legs). The process involves identifying cross-category nodes such as buy online pickup in store (BOPIS) and buy online return in store (BORIS) and loss nodes disconnected from the product flow (loyalty and credit card fraud, administration errors). It also involves reviewing, modifying, creating, reinforcing, monitoring, and managing related processes and procedures. Governance oversees the execution of these processes and procedures, including identifying and creating the entity with primary accountability, creating cross-functional teams with assigned responsibilities, establishing collaborative ways of working, and aligning objectives and incentives.

Reporting and insight: Reporting provides visibility into baselines and progress against key performance indicators (KPIs). Diagnostic assessment includes creating loss typology, terminology, and definitions (loss buckets, loss vs. cost, and KPIs) and ensuring accuracy, timeliness, and completeness. Insight enhances understanding and supports action through hierarchies and segmentations, and KPI baseline confirmation. It aids in setting KPI improvement targets, analyzing trends and patterns, and gauging use and acceptance. It also helps in identifying the need for new KPIs, hierarchies and segments, and expanded typology.

Data, tools, and automation: Data and tools ensure all end users (across functions and levels) have access to the necessary information for decision-making. Diagnostic assessment includes establishing and maintaining a single source of truth; ensuring data accuracy and timeliness; adhering to measurable, manageable, meaningful principles; addressing data gaps; and providing tailored analysis and visualization by function and role. Automation optimizes accuracy and timeliness by transitioning from manual to touchless processes, continuously syncing source and operational data, and avoiding estimation.

Data science and AI-ML: Data science and artificial intelligence and machine learning (AI-ML) can overcome data access and manipulation challenges, enabling predictive and prescriptive total retail loss use cases. For example:

While many larger retailers are confident that data to calculate most of the total retail loss buckets exists within their organization, concerns arise regarding the cross-functional dispersion and complexities associated with accessing and collating the data. AI-ML can help address these concerns effectively.

With the right data and training, AI-ML models can predict where and when retail loss events are likely to occur and recommend interceding actions for mitigation. These capabilities are expected to improve rapidly as AI-ML continues to evolve and mature.

Architecture and integration: Tailor the architecture and integration requirements to the specific situation and circumstances identified during diagnosis, with the objective of optimizing current cost and performance, while providing flexibility for future landscape changes.

Addressing organizational inertia

Mitigating shrinkage requires transparency, reassurance, and support from the senior leadership.

All major business transformations are sure to be met with some level of organizational inertia, particularly those with more than 100-year legacies to overcome. Arguably, loss prevention (LP) leaders have the perfect combination of C-suite focus on retail shrinkage along with little pushback from the finance function as to the business case. For some, confining shrink to loss prevention and leaving the responsibility for loss spread out and functionally siloed will be far more comfortable and less risky than centralizing primary accountability within a single cross-functional entity. When moving forward with total retail loss, retailers must be careful to conduct an assessment and take preemptive steps to minimize organizational antagonism and create alignment through transparent explanation, reassurance, and senior leadership support.

Change management best practices include:

Positioning total retail loss as a portfolio of potential wins to be prioritized and implemented incrementally, targeting realistically manageable quick wins first

Advocating for total retail loss as an agent of change by collecting data, prioritizing tasks, and then recommending constructive, gainful actions to those best placed to deliver

Communicating clearly, focusing on simplicity, and avoid getting bogged down by terminology

Celebrating and building on successes, leveraging momentum to use total retail loss as an analytical lens for the evaluation of innovation and change

The way forward

As the retail sector evolves, shrinkage demands a modern approach.

Our diagnostics-based blueprint for total retail loss transformation offers a solid foundation, adaptable to various retail environments. Through a comprehensive diagnostic assessment and targeted implementation, retailers can modernize their approach to shrinkage, unlocking significant business benefits while ensuring a more resilient and sustainable future for the retail industry.

© Copyright [2024], Tata Consultancy Services Limited. All Rights Reserved.

Document ID CGTC010548

Unauthorized access, copying, replication, distribution, transmission, modification, adaptation or translation or use without express written permission is prohibited.